Orginally Written by Aditya Shastri

Updated on Dec 11, 2025

Share on:

DMart - officially Avenue Supermarts Ltd, is one of India’s leading value-retail chains, known for everyday low pricing and lean operations. In 2024-25, it operated 415 stores across India and employed 13,971 permanent + 59,961 contractual staff.

Its position in 2025 is that of a mature, cost-driven retailer facing both growth pressures and competitive disruption. Why analyze DMart via SWOT now? Because the Indian retail landscape is shifting rapidly: rising e-commerce, rising input costs, evolving consumer expectations.

For entrepreneurs, marketers, and strategy students, understanding DMart’s internal and external levers offers rich lessons in scaling a retail business in a volatile environment.

Before diving into the article, please note that the research and initial analysis for this piece were conducted by K. Sneharani Patra. She is a student of IIDE’s Online Digital Marketing course, May Batch 2025.

If you found this analysis helpful, please feel free to reach out to her to send a quick note of appreciation for her fantastic research, she will appreciate the kudos!

About DMart

Founded in 2002 by Radhakishan Damani, DMart (Avenue Supermarts Ltd) is headquartered in Mumbai. It operates in the supermarket/hypermarket sector across India, positioning itself as a value-for-money, one-stop shopping destination. Its slogan revolves around providing essential goods at affordable prices, and its expansion strategy has historically been cautious but steady.

| Item | Detail |

|---|---|

| Official Name | Avenue Supermarts Ltd (DMart) |

| Founded | 2002 |

| Founder | Radhakishan Damani |

| Headquarters | Mumbai, Maharashtra, India |

| Industries | Retail, Supermarkets, Hypermarkets |

| Geography | Pan-India (12 states/UTs) |

| Stores (2025) | ~415 stores |

| Employees | ~13,971 permanent + 59,961 contractual |

| Latest Revenue (FY24/25) | ~ ₹63,316 crore in operations |

| Net Profit | (Refer to financial statements) |

| Major Competitors |

Big Bazaar, Reliance Retail, BigBasket, Amazon Pantry, Spencer’s |

Why SWOT Analysis of DMart Matters in 2026?

- Intensifying competition: Traditional retail chains are modernizing; e-commerce & quick commerce players are encroaching.

- Rising cost pressures: Inflation, input costs, logistics, real estate are squeezing margins.

- Consumer shifts: More customers expect omnichannel experience, faster delivery, loyalty perks.

- Technology & data: Retailers are increasingly leveraging AI, analytics, and supply chain automation.

- Sustainability & ESG: Retail chains are under scrutiny for waste, packaging, supply chain ethics.

In this dynamic context, a SWOT analysis reveals where DMart can leverage strengths, mitigate weaknesses, seize new paths, and defend against threats.

Learn Digital Marketing for FREE

SWOT Analysis of DMart

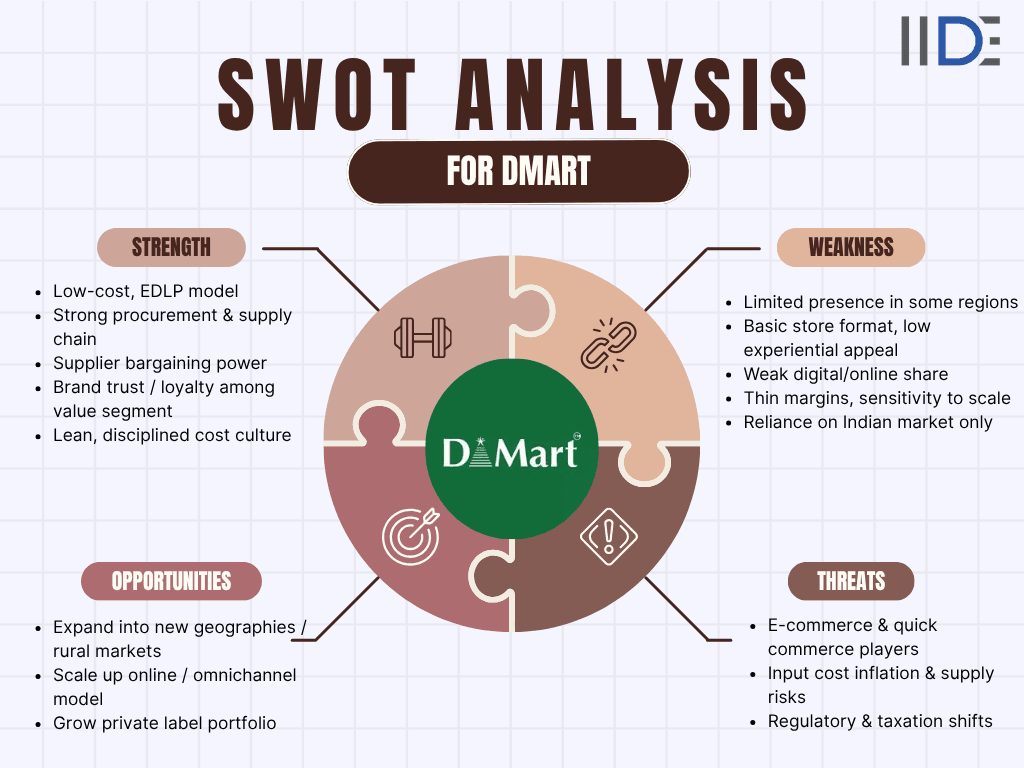

1. Strengths of DMart: How India’s Value Retailer Keeps Winning in 2025

Low-Cost Leadership & EDLP (Everyday Low Price):

DMart operates on a value pricing model, passing cost savings to consumers. This helps it attract highly price-sensitive customers, especially in non-metro and tier-2/3 markets.

Efficient Supply Chain & Bulk Procurement:

By purchasing directly in large volumes, maintaining tight inventory control, and reducing intermediaries, DMart keeps input costs suppressed.

Strong Negotiating Power with Suppliers:

Owing to its scale and volume, DMart wields leverage when negotiating terms, enabling favorable margins.

Brand Loyalty & Value Reputation:

Among price-conscious consumers, DMart has built trust over years for delivering essentials reliably and affordably.

Disciplined Cost Culture & Lean Operations:

Minimal advertising spend, lean staffing, and frugal operations underpin its sustainable margin model.

2. Weaknesses of DMart: Where the Cost Champion Still Struggles

Uneven Geographic Penetration:

DMart has relatively weaker presence in southern and northeastern states relative to western and central India.

“No Frills” Store Format:

The store ambience is basic; it lacks premium ambience, experiential elements, or décor which some newer retail chains offer.

Underdeveloped Digital / E-Commerce Presence:

Although DMart launched “DMart Ready” (its online channel), its share of overall sales is still modest, and online operations have shown losses as it scales.

Thin Margins Dependent on Scale:

The business is vulnerable to margin erosion if scale growth slows or costs rise significantly.

Concentration on Indian Market:

DMart’s operations are almost entirely in India, making it susceptible to domestic macroeconomic risks.

Read DMart’s marketing strategy that centers on everyday low prices and seamless shopping, making it India’s favourite value retailer.

3. Opportunities for DMart: Paths to Scale, Tech, and Retail Innovation

Further Geographic Expansion & Penetration:

Entering underserved states (esp. in South, East, Northeast) and rural markets can unlock new growth.

Strengthening Omnichannel & E-Commerce:

Integrating offline + online, leveraging dark stores or hub-and-spoke models, optimizing last-mile delivery.

Private Label / House Brands:

Expanding own-brand offerings can boost margins and differentiate from competitors.

Tech / Data Analytics Investments:

Use AI, demand forecasting, predictive replenishment, smart checkout & inventory optimization.

Strategic Partnerships or Acquisitions:

Tie-ups with local delivery aggregators, tie-ins with fintech/loyalty platforms, M&A of smaller retail chains.

4. Threats to DMart: Disruption, Costs, and the New Retail Battlefield

E-Commerce & Quick Commerce Disruption:

Giants like Amazon, Flipkart, and quick commerce players (e.g. Dunzo, Swiggy Instamart) pose major competitive pressure.

Input Cost Inflation & Supply Chain Volatility:

Rising fuel, raw materials, labour costs, logistics, and inflationary pressures can erode margins.

Regulatory / Taxation Changes:

Changes in GST, import tariffs, retail sector regulation can adversely impact pricing and operations.

Aggressive Competition from Unorganized Retail:

Local kirana shops can adapt (e.g. apps, credit, hyperlocal delivery) and reclaim consumer loyalty.

Macroeconomic Slowdown / Consumer Sentiment:

In case of slowdown, discretionary and non-food spending may get hit first, affecting basket mix.

IIDE Student Takeaway, Conclusion & Recommendations

Key Takeaways

- Biggest Advantage: DMart’s cost discipline, scale, and brand trust give it resilience in a tough retail environment.

- Biggest Risk: Margin erosion from rising costs or failure to adapt digitally could erode its core edge.

Strategic Recommendations

- Accelerate Omnichannel Integration: Create seamless overlap between online and offline, invest in click-and-collect, dark stores.

- Expand Geographic Reach Smartly: Prioritize states with lower current retail infrastructure and favorable demographics.

- Boost Private Label & Margin Levers: Introduce more in-house brands to improve gross margins and differentiation.

- Use Data & AI: Optimize forecasting, inventory, dynamic pricing, and customer personalization.

- Protect Against Cost Inflation: Negotiate long-term input contracts, hedging strategies, improve logistics efficiency.

Future Outlook

By leveraging its strengths in cost discipline and brand trust, while addressing weaknesses like digital lag and thin margins, DMart can capitalize on opportunities in omnichannel retail and private labels.

Yet, it must stay alert to threats from rising costs, online competition, and regulatory pressures. If DMart succeeds in uniting its strong foundation with tech-driven agility, it can continue leading India’s retail revolution rather than being overtaken by it.

Want to Know Why 2,50,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 23, 2026

Duration

11 Months

Live & Online

Best For

Working Professionals

Mode of Learning

Online

Starts from

Mar 6, 2026

Duration

4-6 Months

Online

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

DMart operates on a low-cost, high-efficiency model by sourcing directly from manufacturers, keeping operational expenses minimal, and passing savings to customers, making it the go-to destination for value shopping in India.

Yes, DMart has expanded its digital presence via the DMart Ready app and website, offering online ordering and home delivery or pick-up services in major cities for greater convenience.

DMart typically revises prices and adds new offers weekly (often on Fridays), ensuring that customers always have access to fresh deals and competitive prices.

No, DMart’s operations are currently limited to India, where it has an extensive network of hypermarkets and convenience stores.

DMart focuses on a limited but diverse selection of fast-moving household essentials, and it regularly audits suppliers to maintain affordable pricing without compromising on product quality.

High foot traffic is common, especially on weekends and during sales, leading to operational inefficiencies, customer dissatisfaction, and a need for better store layout and security measures.

Yes, DMart has introduced its own brands for essentials, groceries, and household items, which are increasingly popular among value-conscious Indian consumers.

DMart’s resilience comes from its relentless focus on cost control, operational efficiency, and customer loyalty, maintaining its edge even as e-commerce and other modern trade players intensify competition.

DMart targets densely populated urban and semi-urban areas, expanding its presence steadily while prioritizing profitability, and adapting to changing consumer needs with new store formats and digital innovation.

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.