Orginally Written by Aditya Shastri

Updated on Dec 12, 2025

Share on:

Chanel is one of the world’s most iconic luxury fashion houses, known for its timeless elegance, heritage craftsmanship, and prestige.

In 2024, however, the brand faced a turning point. The revenue declined, profits fell, and industry pressures mounted. But that hasn’t dampened Chanel’s resolve. With strategic bets on creativity, global presence, beauty & fragrance, and brand value, the company is recalibrating for resilience.

Why does understanding Chanel’s SWOT now matter? Because luxury consumers, industry competition, and global economies are shifting fast. Entrepreneurs, fashion students, and brand strategists can learn from what Chanel is doing right, and where risks lie.

Chanel is investing in sustainable infrastructure, supply chain improvements, artisan craftsmanship, and real-estate that aligns with its long-term brand premium. Ongoing price increases, particularly for leather goods/ iconic bags; part of cost-mitigation and margin-protection strategy. This has both maintained luxury prestige and triggered some consumer pushback.

Before diving into the article, please note that the research and initial analysis for this piece were conducted by Samidha Hande. She is a student of IIDE’s Online Digital Marketing Course, May Batch 2025. If you find this analysis helpful, please feel free to reach out to her with a brief note of appreciation for her research; she will welcome the feedback.

About Chanel

- Founding Year & Founder: Founded in 1910 by Gabrielle “Coco” Chanel in Paris.

- Headquarters: Paris, France.

- Relevance in 2024-25: As of 2024, Chanel remains among the top luxury brands globally, leading in brand value growth, even while seeing its first full-year decline in revenue since the pandemic.

- Brand Slogan & Meaning: Chanel stands for elegance, timelessness, and haute craftsmanship. Its codes, tweed, quilted leather, camellias, the iconic 2.55 bag, No. 5 fragrance are widely recognised.

- Hook Stat: In Brand Finance’s 2025 Luxury & Premium ranking, Chanel’s brand value surged 45% to US$ 37.9 billion, overtaking Louis Vuitton to become the second-most valuable luxury brand.

- Creative Leadership Change: Matthieu Blazy was appointed as Creative/Artistic Director. His first collection for Chanel is set for October 2025.

- Investments in Retail, Boutiques & Experiences: Substantial increase in capital expenditure (~43%) in 2024; opening new boutiques; enhancing physical customer experience; expanding beauty / fragrance standalone boutiques.

Why SWOT Analysis Matters for Chanel?

- Competitive landscape: Luxury is crowded. Brands like Dior, Hermès, and competitors in the beauty sector are innovating fast. Standing still is not an option.

- Shifting consumer preferences: Younger luxury consumers care about sustainability, digital experiences, transparency and not just heritage and logos.

- Impact of macroeconomic & cost pressures: Inflation, cost of raw materials, labor costs, supply chain challenges. Also regional instability, currency fluctuations.

- Regulatory, environmental, and social pressures: Sustainability, ethical sourcing, global trade policies, all these factors are becoming more important.

- Brand value & legacy in flux: Chanel’s recent drop in profits, but strong brand value growth, suggests tension between short-term financials vs long-term reputation and investment.

All of this makes Chanel’s SWOT analysis more than just an academic exercise. It carries real implications for the brand’s success or failure in the coming years.

Learn Digital Marketing for FREE

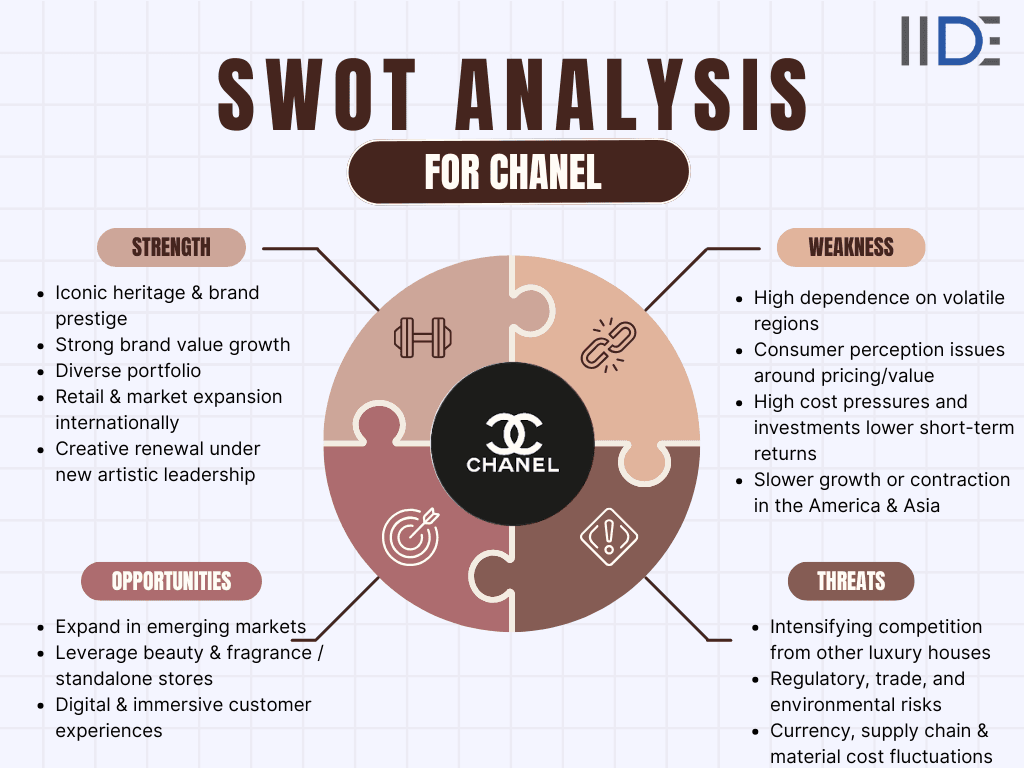

SWOT Analysis of Chanel

1. Strengths

- Strong heritage & brand prestige: Over a century of reputation; signature products (2.55 bag, tweed suits, No.5 fragrance) give Chanel a durable brand identity.

- Exceptional brand value growth: Up ~45% in 2025 to US$ 37.9 billion, leading the luxury rankings.

- Diverse product portfolio: Fashion, leather goods, high jewelry, beauty & fragrance. Beauty segment remains a strong cash earner and more resilient.

- Global reach and retail expansion: Opening standalone beauty boutiques (53 in 2024, more in 2025), pushing into new markets (India, Mexico, etc.).

- Creative renewal: New artistic director Matthieu Blazy, with fresh creative direction and runway shows that balance respect for heritage with modern aesthetics.

- Pricing power and exclusivity: Chanel continues to command very high prices (e.g. Classic Flap bag > US$10,000) and raise prices periodically to reinforce luxury positioning.

2. Weaknesses

- Declining revenue & profit margins: In 2024 Chanel saw a ~4.3% drop in revenue and ~30% drop in operating profit.

- Heavy dependence on certain regions: Asia Pacific, especially Mainland China, plays a crucial role; a weaker consumer environment there causes large swings.

- Overpricing perception & consumer pushback: While price increases reinforce prestige, they risk alienating certain consumer segments; there’s concern about “price vs perceived value.”

- Greater operating cost/investment burdens: Chanel is investing heavily - capex up >43% in some reports but this also draws down profits in the short term.

- Slower growth in some markets: Americas also saw decline; in Europe modest growth but not enough to offset weaknesses elsewhere.

Explore the SWOT analysis of Shoppers Stop to understand how their strategic strengths and challenges shape their market positioning and growth potential.

3. Opportunities

- Emerging markets expansion: India, Mexico, other parts of Asia, Latin America, etc., offer growth potential. Chanel has already begun expansion moves.

- Beauty & fragrance/standalone boutiques: Chanel’s beauty segment is growing; the expansion of direct retail (standalone boutiques) gives more control over customer experience.

- Creative innovation & sustainable luxury: Using Blazy’s creative direction plus sustainability could attract younger consumers and satisfy regulatory/ethical demands. For example exhibitions like le19M in Tokyo, craft partnerships, etc.

- Digital experiences & storytelling: Virtual shows, immersive crafts, collaborations with artisans, better e-commerce/omnichannel integration. Consumers expect more than just products.

- Adjusting pricing strategy strategically: Slowing down or moderating price hikes in areas where it might hurt demand; differentiating by market to maintain it.

4. Threats

- Luxury sector slowdown: Global economic uncertainties, inflation, weaker consumer confidence, especially in key regions like Asia and Americas.

- Competition intensifying: Other luxury brands (Hermès, Dior, etc.) and fashion houses increasing creative output, expanding product lines, and innovating more aggressively.

- Regulatory & trade risks: Tariffs, import/export restrictions, environmental regulations, sustainability mandates.

- Changing consumer values: Younger consumers might prioritise sustainability, ethical production, transparency could lead to backlash if a brand is seen as not doing enough.

- Overreliance on price increases: If Chanel keeps raising prices without corresponding perceptions of added value, could risk pricing out customers or attracting negative feedback.

IIDE Student Takeaway, Conclusion & Recommendations

Takeaways

- Chanel’s biggest advantage lies in its heritage, brand equity, and creative renewal - factors that continue to drive brand value even when revenue and profits dip.

- Its investments in beauty & fragrance, expansion into new markets, and emphasis on craftsmanship and store experience are positioning it for long-term resilience.

- Its biggest risk, however, is the tension between pricing strategy, rising costs, and consumer sensitivity.

- If costs keep rising, demand softens, or macroeconomic headwinds deepen, Chanel could experience further contraction.

Recommendations

- Balanced pricing strategy: Instead of across-the-board increases, use tiered pricing by region, product category, and exclusivity. Offer “entry-luxury” options to attract younger luxury consumers without diluting brand prestige.

- Deepen sustainability & ethical craftsmanship storytelling: Highlight where Chanel is reducing environmental impact, using sustainable materials, showcasing artisan work. This can help appeal to younger consumers and meet regulatory expectations.

- Enhance digital & omnichannel presence: Expand immersive virtual experiences, omni-channel shopping, possibly AR/VR previews, better customer.

- Expand in high-growth emerging markets: India, Latin America, possibly Africa. Localize assortments, collaborate with local artists or influencers, adjust retail footprint accordingly.

- Cost control & margin protection: While investment is necessary, Chanel should continue finding efficiencies in supply chain, materials, and operations to protect margins during downturns.

Conclusion

Chanel stands at a crossroads. Its recent financial dip might seem alarming, but its growth in brand value, robust heritage, and investments into beauty, expansion, and creative leadership give it a strong foundation. If the brand can balance its premium positioning with careful growth and relevance to newer consumers, its future remains bright.

Want to Know Why 2,50,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 23, 2026

Duration

11 Months

Live & Online

Best For

Working Professionals

Mode of Learning

Online

Starts from

Mar 6, 2026

Duration

4-6 Months

Online

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

The shift to digital platforms gives Chanel global reach but also brings challenges - including maintaining luxury exclusivity online, navigating internet-driven criticism, and adapting sales models to meet customer demand for online shopping experiences.

Yes, sustainability is a strategic priority for Chanel. The brand has committed to reducing its environmental impact and increasing transparency, aligning with consumer expectations for ethical sourcing and eco-friendly operations.

Chanel’s SWOT analysis underscores its need to balance a legacy of luxury with modern consumer demands, leveraging its strengths while innovating in digital, sustainability, and product diversification to maintain its elite luxury position globally.

Innovation, especially in product development and digital marketing, is key for Chanel to stay relevant in a crowded luxury market - helping the brand reach new audiences and differentiate itself from competitors.

Chanel targets younger consumers through social media, influencer partnerships, personalized experiences, and innovative product lines - adapting its communication to appeal to digital-first, fashion-forward audiences.

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.