Orginally Written by Aditya Shastri

Updated on Jan 3, 2026

Share on:

CarMax, founded in 1993 by Austin Ligon and Richard Sharp, remains the United States' largest used-car retailer, celebrated for revolutionizing the industry with its "no-haggle" pricing and transparent process.

Serving millions of car buyers annually across 240+ locations nationwide, CarMax has transformed the used vehicle market through transparency and customer trust. In 2026, CarMax continues to dominate with omnichannel retail and data-driven inventory management.

How is the retail giant adapting its "phygital" omnichannel strategy to survive a volatile market? This analysis explores the strategic crossroads CarMax faces today - essential reading for business students and automotive entrepreneurs.

About CarMax 2026

Founded in 1993, CarMax revolutionised used-car buying in the U.S. with its transparent, no-haggle pricing model. With the slogan "The way car buying should be," it has built a reputation for trust and innovation. In 2025, CarMax remains a leader with robust digital channels, in-house financing, and a customer-centric approach. SWOT stands for Strengths, Weaknesses, Opportunities, and Threats. Let’s decode CarMax's position now.

Overview Table:

| Attribute | Details |

|---|---|

| Official Name | CarMax, Inc. |

| Founded Year | 1993 |

| Website URL | www.carmax.com |

| Industries Served | Automotive Retail, Auto Finance |

| Geographic Areas | United States (Nationwide, 255+ locations) |

| Revenue (TTM) | ~$26.35 Billion (Fiscal Year 2025-26 Est.) |

| Net Income (TTM) | ~$500 Million (Fiscal Year 2025-26 Est.) |

| Employees | ~29,700 (Post-Nov 2025 Layoffs Est.) |

| Main Competitors | Carvana, AutoNation, Lithia Motors, Group 1 Automotive, Penske Automotive Group |

Learn Digital Marketing for FREE

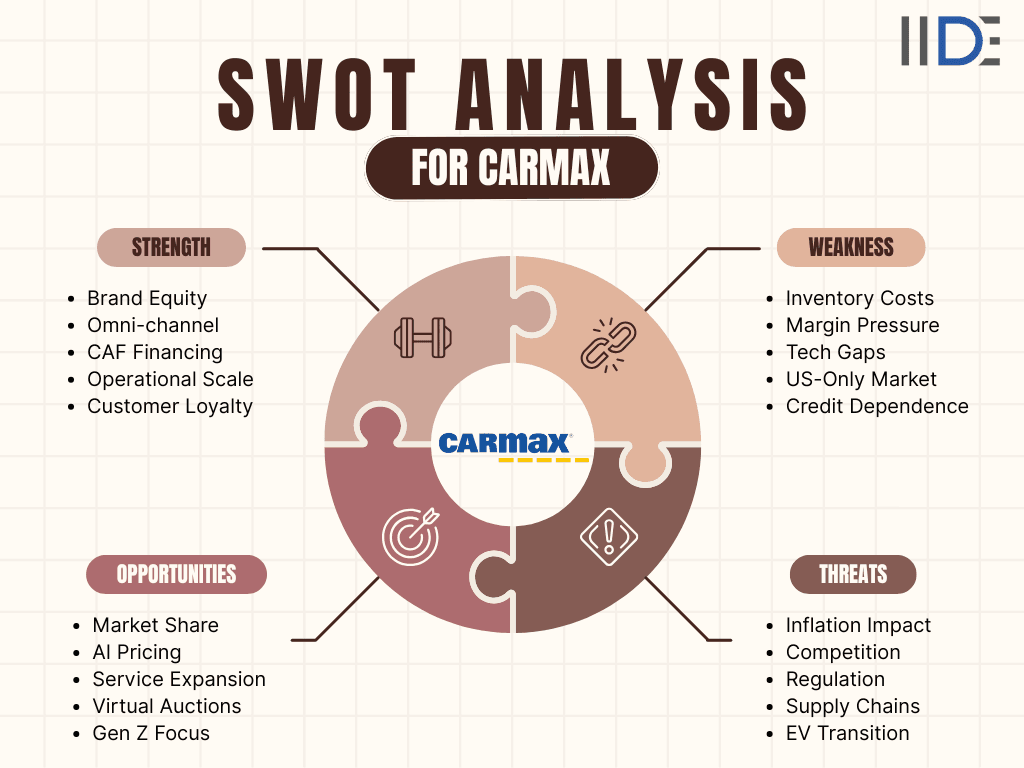

SWOT Analysis of CARmax 2026

Brand Strength

CarMax’s Strengths: The Omnichannel Giant in 2025

Market Leadership & Trust:

- As the largest used-car retailer in the U.S., CarMax holds an unmatched reputation for transparency.

- In an industry plagued by trust issues, their 7-day money-back guarantee and certified quality build immense brand equity.

Robust Omnichannel Ecosystem:

- Unlike digital-only rivals, CarMax successfully blends physical stores with digital tools.

- Customers can buy entirely online, in-store, or a hybrid of both - a "phygital" advantage that lowers return rates compared to pure e-commerce players.

Proprietary Data & Pricing Engines:

- With three decades of sales data, CarMax’s appraisal algorithms are among the most accurate in the world, allowing them to price competitive offers instantly for millions of cars.

CarMax Auto Finance (CAF):

- The company’s captive finance arm is a profit engine, originating over $8 billion in receivables annually, providing a cushion when retail margins compress.

Nationwide Logistics Network:

- Operating over 250 locations allows CarMax to move inventory efficiently across the country to match local demand, a logistical feat smaller dealers cannot replicate.

SWOT analysis of eBay provides insights into how online platforms manage trust, scale, and user experience: similar challenges faced by CarMax.

Brand Weaknesses: Challenges CarMax Must Tackle

Leadership & Strategic Uncertainty:

- The sudden transition of CEO Bill Nash to Interim CEO David McCreight in late 2025 has created strategic ambiguity.

- Markets often react negatively to leadership vacuums during turnaround periods.

High Operational Overhead:

- Unlike Carvana or private sellers, CarMax maintains a massive physical footprint (stores, reconditioning centers) and a 30,000+ person workforce.

- This high fixed cost structure makes them vulnerable when sales volume dips

Pricing Perception:

- To cover these overheads, CarMax vehicles are often priced higher than local dealers or private parties.

- In a high-inflation economy (2024-25), price-sensitive consumers have migrated to cheaper alternatives.

Declining Market Share Trend:

- Recent quarters have shown flat or declining unit sales while competitors like Carvana have seen stock prices surge and efficiency gains, indicating CarMax is losing its "disruptor" edge.

Brand Opportunities:

CarMax’s Opportunities: Future Moves for Growth

Used EV Leadership:

- CarMax is positioning itself as the trusted authority on used Electric Vehicles.

- By partnering with companies like Recurrent to provide "Battery Health Reports," they can solve the #1 fear of used EV buyers - battery degradation.

Service & After-Sales Expansion:

- Margins on vehicle sales are thin. Expanding the "MaxCare" extended service plans and capturing more repair work from the millions of cars they sell offers a higher-margin revenue stream.

AI-Driven Appraisals:

- Further leveraging AI to automate vehicle inspections and appraisals can significantly reduce labor costs and speed up the inventory acquisition process.

B2B Wholesale Expansion:

- Expanding their dealer-to-dealer auction network allows CarMax to monetize vehicles that don't meet their "retail-ready" standards, turning inventory turnover into a more consistent cash flow.

Threats: Industry and Market Risks

CarMax’s Threats: Challenges in a Competitive Arena

Resurgence of Carvana:

- Carvana’s successful restructuring in 2024-25 has made it a formidable threat again.

- Analysts predict Carvana could overtake CarMax in retail unit volume by 2026, threatening CarMax's title as the market leader.

Interest Rate Sensitivity:

- High interest rates have severely impacted monthly payments.

- Since CarMax relies heavily on financing (CAF), sustained high rates drive customers out of the market or toward older, cheaper vehicles CarMax doesn't typically stock.

New Car Inventory Floods:

- As new car production stabilizes and manufacturers offer incentives, the price gap between new and used cars narrows.

- If consumers can buy a new car for slightly more than a late-model used one, CarMax’s core value proposition erodes.

Depreciation Risks:

- If used car prices crash rapidly (deflation), the billions of dollars in inventory sitting on CarMax lots loses value overnight, leading to massive write-downs.

Business model of Uber offers a perspective on how tech-driven disruption can reshape traditional service industries like automotive sales.

Summary Table: SWOT of CarMax

IIDE Student Takeaway, Conclusion & Recommendations

CarMax stands at a critical juncture in 2026. While its "phygital" infrastructure and brand trust remain powerful moats, the company is no longer the sole disruptor in the room. The competitive resurgence of Carvana and the economic pressure of high interest rates have exposed the vulnerabilities of CarMax’s high-overhead model.

Strategic Dilemma: The core tension for CarMax is Margin vs. Volume. They need competitive pricing to regain volume from digital rivals, but their expensive physical infrastructure requires healthy margins to remain profitable.

Recommendations:

- Aggressive EV Certification: Launch a "CarMax Certified EV" badge with guaranteed battery health warranties to own the secondary EV market before competitors catch up.

- Tech-Enabled Cost Reduction: Accelerate the deployment of AI in vehicle reconditioning and appraisals to lower the cost-per-unit and allow for more competitive retail pricing.

- Loyalty Ecosystem: Develop a membership model (similar to Amazon Prime) for car maintenance and next-purchase discounts to increase Customer Lifetime Value (CLV).

- Flexible Leasing: Pilot a used-car leasing or subscription program to attract Gen Z consumers who are priced out of traditional financing due to high interest rates.

Future Outlook: To sustain leadership beyond 2025, CarMax must stop playing defense against Carvana and start playing offense on service and trust. If they can successfully transition from just "selling cars" to "managing vehicle ownership" (via service, data, and EV support), they will survive the current leadership transition and thrive.

Want to Know Why 5,00,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 23, 2026

Duration

11 Months

Live & Online

Best For

Working Professionals

Mode of Learning

Online

Starts from

Mar 6, 2026

Duration

4-6 Months

Online

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

More Case Studies

CarMax simplifies the car-buying experience with its no-haggle pricing policy, ensuring that the price you see is the price you pay. This approach is designed to provide a straightforward and transparent process.

CarMax accepts cash, PIN-based debit cards, wire transfers, and personal checks for vehicle purchases. However, credit cards are not accepted for car purchases or down payments.

CarMax offers a 90-day/4,000-mile limited warranty on purchased vehicles, whichever comes first. This warranty covers specific vehicle components and is included at no extra charge.

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.