About BP

The British Petroleum Firm plc (commonly known as BP Amoco plc) is a United Kingdom-based international oil and gas company. In the oil and gas business, it is one of the world’s seven “supermajors.” It is a vertically integrated corporation that engages in exploration and production, refining, distribution and marketing, power generation, and trading across the whole oil and gas industry.

BP is also a barometer firm for the United Kingdom’s economy, and the corporation’s ups and downs have a significant impact on the region’s economy. BP is the world’s third-largest oil and gas company, as well as the leading gasoline retailer in the United States.

The company operates approximately 18,700 service stations worldwide. BP holds 19.75 per cent of Rosneft in Russia, the world’s largest publicly listed oil and gas corporation by hydrocarbon reserves and production. The Anglo-Persian Oil Company was established in 1908 as the predecessor to BP. In 1935, it was renamed Anglo-Iranian Oil Company, and in 1954, it was renamed British Petroleum.

Quick Stats on BP| Founder | William Knox D’Arcy, Charles Greenway |

|---|

| Year Founded | 1908 |

|---|

| Origin | London, England, United Kingdom |

|---|

| No. of Employees | 70,100 |

|---|

| Company Type | Public |

|---|

| Market Cap | $92.10 Billion (2021) |

|---|

| Annual Revenue | $183.5 Billion (2020) |

|---|

| Net Profit | $−20.73 Billion (2020) |

|---|

Products of BP

Following are the products sold by BP –

- Oil and Gas

- Fuels and Lubricants

- Wind Power

- Natural Biofuels

Competitors of BP

Below are the top 5 competitors of BP –

- OMV Group

- Polski Koncern Naftowy Orlen

- TotalEnergies

- Chevron

- Shell

Now that we are familiarised with BP’s operations and finance, lets dive into the SWOT Analysis of BP.

SWOT ANALYSIS OF BP

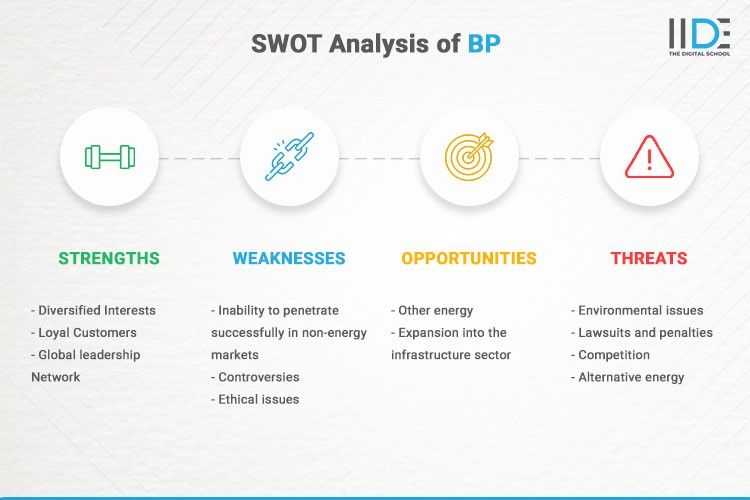

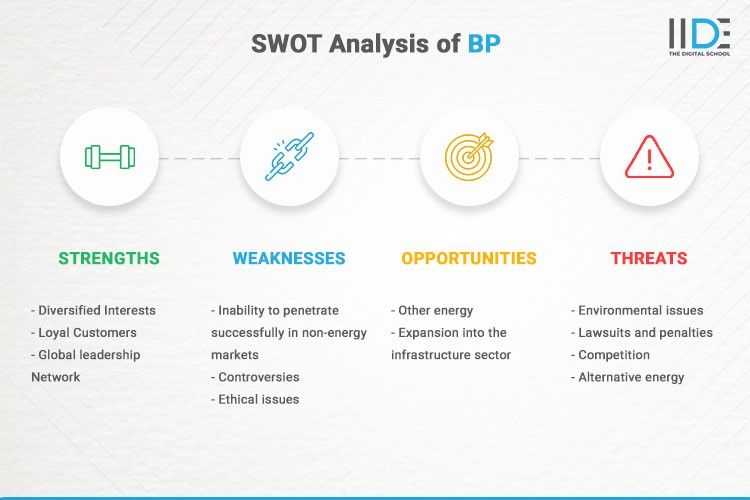

1. Strengths of BP

Strengths are described as what a company excels in its many operations, giving it a competitive advantage. The following are BP’s advantages:

- Diversified Interests – Though British Petroleum’s primary business is oil and gas, the company has expanded into other areas such as lubricants, energy, aviation fuel, and information technology through its numerous subsidiaries such as Amoco, Arco, BP Express, BP Connect; and so on. This aids the organization in risk diversification.

- Loyal Customers – Customers who are brand loyal: BP customers, particularly those in the oil industry, are extremely loyal to the company. They have been procuring from the company for a long time and have a steady and long-term relationship with them. Furthermore, some of the company’s customers rely on British Petroleum for all of their energy needs.

- Global leadership– In most of its areas, the corporation is the market leader. Apart from being the largest oil and gas firm in the UK, the company also plays an important role in maintaining regional economic equilibrium. In the United States, the corporation is the market leader and the largest seller of gasoline.

- Network – The corporation has activities throughout Europe, North America, South America, Africa, and the Asia Pacific in all of its fields. The firm sells through its subsidiary AMOCO in the east and through ARCO in the west and has a total of 17,150 service stations in this territory. The company operates over 11,850 BP-branded service stations worldwide, including 1,525 in the United Kingdom, and sells Castrol-branded lubricants in approximately 50 countries.

2. Weaknesses of BP

Weaknesses are aspects of a company or brand that can be improved.

- Inability to penetrate successfully in non-energy markets-British Petroleum has a wide range of interests, the majority of which are in the energy sector. However, the lack of presence in non-energy sectors may have a long-term impact on the firm.

- Controversies– The firm was involved in a series of scandals involving oil leaks in various regions of the world, which had a significant impact on its sustainability rating and goodwill with stakeholders. Their oil leaks have also resulted in the deaths of marine creatures and have severely harmed the ecosystem.

- Ethical issues– British Petroleum also experienced a series of scandals stemming from dishonest employee transactions, and they handled the spillage situations badly, further damaging the corporation and giving the impression that the company was not sincerely concerned about society or the environment.

3. Opportunities for BP

The term opportunity refers to pathways in the business’s environment that it can use to boost its profits. Among the possibilities are:

- Other energy– Because British Petroleum has a strong position in the energy sector, it can investigate alternative energy sources such as tidal or wind energy. The global focus on sustainability is opening up a slew of new prospects in the field of alternative energy. This could be the best path for the company’s development.

- Expansion into the infrastructure sector– BP could try to work with developing economies to develop solutions for infrastructure challenges that use alternative energy sources, which would not only be good for business but also for the BP brand’s image, making it appear more environmentally conscious

4. Threats to BP

Environmental components that have the potential to limit a company’s growth are known as threats.

- Environmental issues– Such as revising workplace safety issues to reduce refinery explosions, oil leaks and spills, pipeline corrosion, and other environmental hazards, may continue to be a threat if the corporation does not establish its corporate social responsibility and place it at the heart of its strategy, it will face serious consequences.

- Lawsuits and penalties-If the company does not solve these environmental issues and inadequate safety standards, it will continue to face litigation and penalties, which will have a severe influence on the company’s long-term viability.

- Competition-Other firms, such as Shell and Chevron, are posing more competition because they are better at dealing with environmental challenges than BP and have improved their brand reputation.

- Alternative energy-BP also faces competition from the advent of specialized alternative energy companies that are offering the technology and affordability to drive a bigger shift away from dependency on fossil fuels, which might reduce the company’s client base.

With this, we come to the end of the SWOT Analysis of BP. In the following section, let’s briefly conclude the case study.