Updated on Aug 9, 2025

Share on:

The last time we saw the Marketing Strategies of Bajaj Finserv, this time we will look at the SWOT Analysis of Bank of Maharashtra.

Headquartered in Pune, the Bank of Maharashtra is a nationalized bank owned by the Government of India. It has a whopping amount of 15 million customers around the country and about 2,000 branches in the state making it the largest nationalized bank in Maharashtra.

The bank offers services like savings deposits, credit cards, current deposits, term deposits, educational loans, housing finance, vehicle loans, personal loans, consumer loans, gold loans, pension plans, life insurance, and non-life insurance solutions.

One of the hindrances in the growth and visibility of the bank is its poor marketing skills, in today’s time digital marketing is very important for reaching out to customers as everything is shifting towards digital. If you want to learn digital marketing and its scope, do check out Free Digital Marketing Masterclass by Karan Shah, the founder and CEO of IIDE.

As a result, the purpose of this article is to supply you with useful information about the brand, including the most recent statistics and updates. So, let’s get to know the Bank of Maharashtra a little more before we go into the SWOT analysis of Bank of Maharashtra.

About Bank of Maharashtra

Bank of Maharashtra (BOM) is a public sector bank that provides financial services in the country. The bank offers a range of banking products and services to individuals and businesses. Nationalized in 1969, it provides financial services to many startups and small-scale businesses and also gave birth to many prominent industrial houses.

The equity shares of the Bank of Maharashtra are listed on the Bombay Stock Exchange and the National Stock Exchange of India. Since its nationalization, the government had a 92.4% share in it.

In 2021 itself, the Bank of Maharashtra has bagged awards like the ‘Kirti Puraskar’, ‘Best Employer Brands Award 2021’, ‘Best IT and Cyber Security Award’, ’Top Improvers’, and many more.

Quick Stats About Bank of Maharashtra

| Founder | D.K. Sathe and V.G. KaleSingh |

|---|---|

| Year Founded | 1935 |

| Origin | Pune, India |

| No. of Employees | 13,048 (2020) |

| Company Type | Public |

| Market Cap | 13999 Cr (2021) |

| Annual Revenue | 13144.67 Cr (2020) |

| Net Income/ Profit | 385 Cr (2020) |

Services Provided by Bank of Maharashtra

Bank of Maharashtra provides services in the following areas:

- Consumer Banking

- Corporate Banking

- Finance and Insurance

- Investment Banking

- Private Banking

Competitors of Bank of Maharashtra

There are numerous players in the banking industry, the top 5 competitors are as follows:

- State Bank of India

- Bank of Baroda

- IDBI Bank

- India Post Payments Bank

- Bank of India

Now that we’ve got to know about the bank, let’s proceed further and take a look at the SWOT Analysis of Bank of Maharashtra.

SWOT Analysis of Bank of Maharashtra

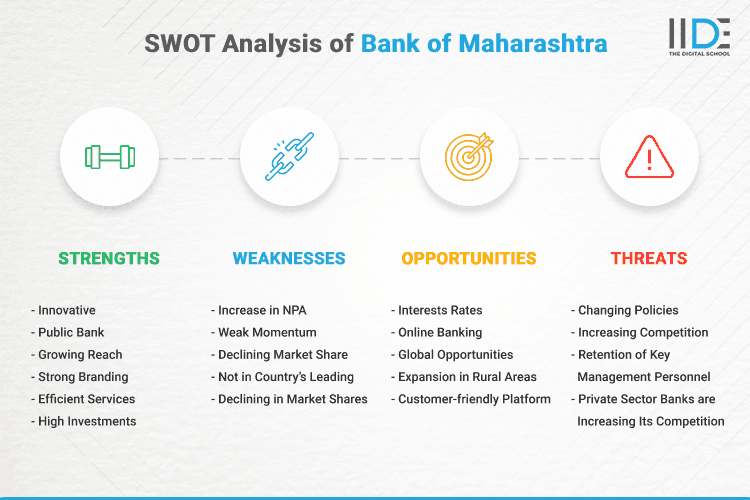

A SWOT Analysis is a tried and tested tool that helps one to understand the Bank of Maharashtra and the comparison of its business with its competitors and have an idea of the overall position of the bank. The strengths and weaknesses are the internal factors in this analysis while the opportunities and threats are the external factors involved.

To better understand the SWOT analysis of Bank of Maharashtra, refer to the infographic below:

So let us first start by looking at the strengths of Bank of Maharashtra from the SWOT analysis of Bank of Maharashtra.

Strengths of Bank of Maharashtra

- Public Bank: Since the bank is a public sector undertaking, it has the backing of the government including financial support and legal assistance.

- High Investments: It has very high investments in SLR securities which gives Bank of Maharashtra a certain edge over its competitors in terms of the nation’s secure bank.

- Efficient Services: The bank is efficient in managing its assets and providing ROA which is also improving over the last 2 years. The services provided by the bank are also sufficient for the general public.

- Growing Reach: The geographic existence in various states works as one of the major strengths of the organization. The bank of Maharashtra has over 1500 branches in 23 states and 2 union territories. This helps the bank to reach more customers.

- Strong Branding: The bank of Maharashtra has a very strong brand in the regional and primary bank industry, this helped the bank to attract more customers.

- Innovative: The Bank of Maharashtra provides every service to their customers from e-banking to loan facilities to everything. Online Telebanking facilities are available to all its core customers and individuals as well as corporate.

Bonus Tip: BOM offers online services like UPI app for easing the transaction process, net banking services, U-Control app for credit card users. Digitalisation has benefited customers with a cashless and hassle-free experience while banking. So, isn’t investing in learning digital marketing skills worth the investment? If you think yes, then there are several short-term courses in IIDE that will help you learn about digital marketing and how to leverage its power to grow.

Weaknesses of Bank of Maharashtra

- Weak Momentum: There is a weak momentum as the stocks of Bank of Maharashtra are trading below the short, medium, and long term averages.

- Not in Country’s Leading: Due to its majority of income coming from loans, retail and personal banking only, it somehow lags in presence in India and other continents compared to leading Indian banks.

- Declining Market Share: This is due to the consumer financial services industry growing at a faster rate than the company. In such a scenario, Bank of Maharashtra needs to carefully analyze various trends within the financial sector to understand what to do to drive future growth.

- Increase in NPA: There has been a considerable increase in the bank’s NPAs. Leading to a reduction in the ability of the bank for lending more thus resulting in less interest income.

- Declining in Market Shares: The competitors of the bank of Maharashtra have upgraded their system and started providing E-banking facilities and making user-friendly interfaces but the bank of Maharashtra didn’t bring changes early and failed to capture the market.

Opportunities for Bank of Maharashtra

- Expansion in Rural Areas: The bank of Maharashtra is available in different locations in India and in rural areas, the bank should take the opportunity of this and gain the trust of rural people by providing them loan facilities and spreading awareness of banking, loan and mortgage facilities to rural people.

- Interests Rates: Reduction in interest rates make fundraising and financing at lower cost simpler for the business organization. BOM can make credit cards more profitable by increasing the interest rate and the non-performing assets can be eased.

- Online Banking: Bringing the changes on time is very important. The world is changing rapidly, so if the company is not bringing changes their competitors can take the benefits from it and nowadays many people are shifting towards online banking the bank must make the platform user friendly.

- Customer-friendly Platform: The target audience of the bank of Maharashtra is the middle class and primary people. They can grab the opportunity by creating a user-friendly platform that can be used by each and every class.

- Global Opportunities: A major opportunity for financial service players in the Indian market is the global financial service market, it is inarguably that the global market is worth billions of dollars. Bank of Maharashtra is mainly focused on the Indian market, which needs to increase its reach outside the Indian market as well making it gain more customers.

Threats to Bank of Maharashtra

- Increasing Competition: Competition in the finance sector is increasing vigorously. Many competitors like HDFC, Bank of India, State Bank of Maharashtra and Canara bank bring many changes in their strategy and make their platform user-friendly and bring it online.

- Changing Policies: Banking policies are governed by Reserve Bank of Maharashtra (RBI) laws and regulations, therefore any changes made by the RBI have a direct impact on the bank’s operations.

- Private Sector Banks are Increasing Its Competition: Private sector banks are developing novel investment packages and thereby gaining market share among retail consumers.

- Changing Demographics: The baby boomer generation has retired and the new generation is having a hard time replacing purchasing power. This may increase the profits of AU Bank in the short term, but younger people are less loyal to brands and more open to experimentation, resulting in lower profit margins in the long run.

- Retention of Key Management Personnel: Developing and retaining key executives can be difficult as multiple new banks, fintech companies, and existing banks are competing for the same talent pool.

This ends our study on the SWOT analysis of Bank of Maharashtra. Let us conclude our learning below.

Learn Digital Marketing for FREE

To Conclude,

To sum up, BOM has a huge mass of incredibly innovative services providing enough options. The company has the advantage of the brand trust of thousands in India. It has been updated with technology although not the most advanced but not behind as well; however, BOM should start focusing on creative advertisement to attract more inventors in India as well as internationally.

With a huge increase in the service industry. There is a very high competition where marketing plays a crucial role-taking advantage of technology not merely in this industry in which every other company is focusing on digital marketing to rise ahead of each other. If you have the curiosity to learn you may check out IIDE’s 3 Month Advanced Online Digital Marketing Course to know more.

We hope this blog on the SWOT analysis of Bank of Maharashtra has given you a good insight into the company’s strengths, weaknesses, opportunities and threats.

If you enjoy in-depth company research just like the SWOT analysis of Bank of Maharashtra, check out our IIDE Knowledge portal for more fascinating case studies.

Thank you for investing your valuable time to read this, and do share your thoughts on this case study of the SWOT analysis of Bank of Maharashtra in the comments section below.

Want to Know Why 2,50,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Post Graduate in Digital Marketing & Strategy

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 2, 2026

Duration

11 Months

Live & Online

Advanced Online Digital Marketing Course

Best For

Working Professionals

Mode of Learning

Online

Starts from

Jan 23, 2026

Duration

4-6 Months

Online

Professional Certification in AI Strategy

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Undergraduate Program in Digital Business & Entrepreneurship

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.