Students Centric

Placements Report

Trackable results, real numbers

Reviews

Proven success, real voices

Trainers

Expert-led, Industry-Driven Training

Life at IIDE

Vibrant Spirit student life

Alumni

Successful Journeys, Inspiring Stories

Learning Centre

Webinars

Blogs

Case studies

Live, Interactive Masterclasses

Fresh Insights, quick reads

Real-life, Industry relevant

More

Hire from us

Hire Top Digital Marketing Talent

Work with us

Join Our Team, Make an Impact

Customised Training

Personalised digital marketing training for your company

Refer & earn

Simple, easy rewards

Contact us

Get the answers you need

About us

Know more about IIDE

Explore all course options

Trending

Professional Certification in AI Strategy

- Ideal for AI Enthusiast

Updated on Aug 9, 2025

In our previous article, we have discussed in detail the SWOT analysis of NatWest. In this article, we are going to elaborate on the marketing strategy of Natwest.

The objective of this blog is to provide a detailed insight on Natwest, considered one of the Big four clearing banks in the UK.

Marketing is much more than just selling and advertising. Marketing allows us to be influenced as consumers by showing us a standard of living that can be achieved or providing opportunities to live a certain way. If you are interested in digital marketing, then you should definitely check out IIDE’s Free MasterClass on Digital Marketing 101 by our CEO and Founder, Karan Shah.

We will cover the entire marketing strategy of Natwest in this blog. Before we begin our in-depth study let us start with learning the company’s story, target audience and digital presence.

About Natwest – Bank Overview

NatWest came into being in 1970 by the merging of three well-known banks of the time: Westminster Bank, National Provincial Bank and its subsidiary District Bank. In 2000, through a 21 billion dollar deal, the Royal Bank of Scotland acquired NatWest – this was the biggest deal in British history at that time. This group continued to grow and operated several other banking brands. However, after the economic downturn in 2008, the RBS became highly vulnerable and became partially owned by the government. The group’s name was changed to NatWest.

Today, NatWest has over 3400 cash machines all over the UK and 960 branches to serve nearly 7.5 million customers and 850,000 small business accounts. In 2019, NatWest reported a profit of 1,326 GBP million in comparison to the 3,526 million GBP in 2018. This decrease can be attributed to impairment losses and an increase in operating expenses.

With assets worth £799.491 billion and equity of £43.824 billion as of 2020, it can be said without a doubt that NatWest is an integral part of the British economy. The group has a net worth of $32.27B as of November 30th, 2021. In addition to having a primary share listing on the London Stock Exchange, it is also listed on the New York Stock Exchange.

| CEO | Alison Rose |

|---|---|

| CMO | Margaret Jobling |

| Area Served | the United Kingdom |

| Industry | Banking Financial Services |

| Market Share/ Revenue | 2.54% of the domestic market share |

| Vision | We champion potential, helping people, families and businesses to thrive. |

| Tagline | We are what we do |

Marketing Strategy of Natwest

NatWest’s marketing strategy examines the brand using the marketing mix framework, which includes the four Ps (Product, Price, Place, Promotion). Product innovation, pricing strategy, promotion planning, and other marketing strategies exist. These business strategies, based on the NatWest marketing mix, aid in the brand’s success.

Segmentation, Targeting, Positioning

STP begins with segmentation, in which organizations break their marketing into distinct categories depending on factors such as those listed below.

Demographics Segmentation

Geographical Segmentation

Location-Based Segmentation

It identifies the group of buyers based on differences in their desires or requirements. From the beginning, the products of Natwest are segmented based on the customers belonging to similar geographical areas. Besides geography, psychographics and demographics are also considered.

Targeting is a marketing technique that separates a large market into smaller groups to focus on a specific portion of that market. It identifies and caters to a certain client segment based on its unique characteristics. The majority of Natwest’s target audience is individuals with lower and higher income or big business owners or normal individuals.

Positioning shows where your product and goods stand with other company products that sell products that are comparable to yours. Natwest positions itself as a bank that is simple to use, convenient, and safe.

Marketing Campaigns

NatWest ‘This is how we do it’ by The & Partnership London

In this campaign, we are reminded that it is never too early to begin good financial habits. MoneySense, the bank’s free financial education programme, teaches UK children aged 5 to 18 how to be financially confident.

The campaign was run on youtube and it was indeed a success with 4,96,223 views and amazing video content by Kate Allsop, Howard Green, Matt Wood and Tom Loveless, and directed by The Bobbsey Twins through Blink.

“Extraordinary” by Pablo

Pablo, Natwest and ITV launched this campaign on youtube to support SME’s boosting them with a unique blend of business support and media collaboration.

In collaboration with ITV and Pablo, the ad encourages other small businesses to visit the NatWest website for a chance to win one of three TV spots worth more than £150,000 each business. This campaign performed well and received 1.6k views. It was launched in 2020.

“Tomorrow begins today” campaign

Tomorrow Begins Today’s launch to show how NatWest empowers people to take action today so that they can achieve their goals for tomorrow sooner.

The campaign launched in December, with radio, digital audio, social, and print media planned by Zenith. The NatWest Brand Creative Collective, which includes members of the The&Partnership London, co-created the new visual identity and tone of voice for the campaign. The new brand logo incorporates a new brand character, the ‘caring matriarch,’ who is knowledgeable, compassionate, and encouraging, demonstrating to clients that NatWest genuinely cares about them achieving their objectives.

This campaign was indeed a success as it created a new visual identity for the brand.

Social Media Marketing

Natwest is present on various social media platforms like Facebook, LinkedIn, Twitter, Youtube and Instagram.

Facebook: 379k

Instagram: 22.3k

LinkedIn: 89.7k

Twitter: 121.2k

NatWest posts promotional posts on Instagram. For NatWest Business, LinkedIn is an important platform because of its B2-B targeting.

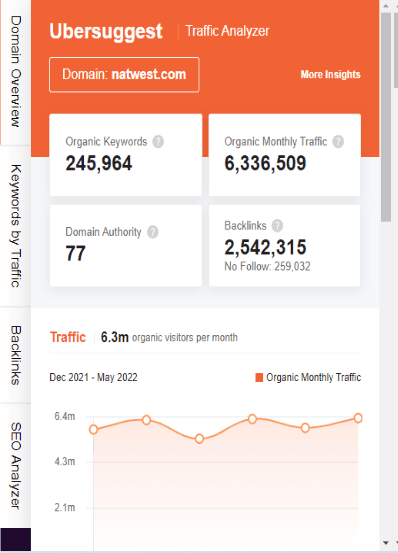

SEO Strategies

As per SEO ranking, it is said that the number of keywords – below 500 is bad, above 1000 is good, and 10,000+ is amazing. As we can see, Natwest has 245k+ organic keywords and it’s out of the box. That means the digital marketing of Natwest is gaining an outstanding number of insights.

Also, the traffic per month is around 6 million+ which is unbelievable. Hence, Natwest Bank has outstanding SEO strategies while working hard enough to keep the brand soaring in the Google organic SERP results.

Influencer Marketing

Through its new campaign, NatWest x Gaming Creator Collective, NatWest is collaborating with influencer marketing agency TAKUMI to shed light on the issue of scams and online fraud threats for young people.

The campaign begins with a one-hour panel discussion at 1 pm on Wednesday, September 8, 2021, and focuses on the gaming industry, which is frequently targeted by fraudsters.

E-commerce Strategies

NatWest has begun testing new technology that will allow customers to make secure purchases online or on their mobile devices without the use of a debit or credit card. Customers will immediately see their balance, updated in real-time, avoiding any surprise transactions or overdraft fees. This is the first service of its kind to be trialled by a UK bank.

Mobile Apps

This mobile app makes day-to-day banking easy, quick and secure. Take the hassle out of banking. The NatWest smartphone app allows account holders to manage their money on the go. One useful feature is its Get Cash service, which allows you to withdraw cash from a NatWest or RBS machine without using your card. The app sends you a one-of-a-kind code, which you enter into the machine.

It’s available to customers aged 11+ with compatible iOS and the UK or international mobile numbers in specific countries

Content Marketing Strategies

Their focus is to champion potential, and help people, families and businesses to thrive. Honister Slate Mine and Alison Hammond feature in the new NatWest and ITV advert. They cover a lot of promotional and informative content on their social media platforms that include their marketing campaigns, tutorials on how to use their mobile app, business climate and so on.

This ends the elaborative marketing strategy of NatWest. Let us conclude our learning below from the marketing strategy of NatWest.

Learn Digital Marketing for FREE

- 45 Mins Masterclass

- Watch Anytime, Anywhere

- 1,00,000+ Students Enrolled

Conclusion – What’s Unique in Natwest’s Marketing?

The bank has had a proud history of ‘firsts’ and working out clever solutions to problems – leading the growth of cash machines during the late 1960s and 1970s.In the 1980s, the Switch debit card was introduced.

NatWest’s marketing strategy assists the brand/company in establishing a competitive market position and achieving its business goals and objectives. The bank is hoping to get the best of both worlds by gradually improving its digital app alongside taking a human-centric approach to banking.NatWest has launched a new TV ad, which first aired on 23 September and has the slogan ‘We are what we do’, which signifies major changes to the brand.

Digital marketing allows you to stay in touch with your target audience at all times. Though digital platforms provide limitless opportunities for businesses, they can also be detrimental to a brand’s reputation if not handled properly. You can build market trust with a strong website and social media channels. Learning about the ever-growing field of digital marketing is an important first step.

If you would like to learn more and wish to gain some practical experience, do checkout IIDE’s 4 Month Digital Marketing Course for more information. If you would like to learn more and develop skills, check out Alternatively, you can enrol in one of our free online masterclasses led by IIDE’s CEO, Karan Shah, to gain insight into the field of digital marketing.

We hope this blog on the marketing strategy of NatWest has given you a good insight into the company’s marketing strategies.

If you like such in-depth analysis of companies just like the marketing strategy of NatWest check out our IIDE Knowledge portal for more fascinating case studies.

Thank you for taking the time to read the marketing strategy of NatWest, and do share your thoughts on this case study marketing strategy of NatWest in the comments section below.

Want to Know Why 2,50,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

Courses Recommended for you

MBA - Level

Post Graduate in Digital Marketing & Strategy

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 2, 2026

Duration

11 Months

Live & Online

Advanced Online Digital Marketing Course

Best For

Working Professionals

Mode of Learning

Online

Starts from

Mar 6, 2026

Duration

4-6 Months

Online

Professional Certification in AI Strategy

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Undergraduate Program in Digital Business & Entrepreneurship

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

- Bosch 2025: Strategic Insights into Market Position, Challenges, and Growth Opportunities

- Nasher Miles Marketing Strategy 2025: A Journey from Trolleys to Trendsetters

- Beco Marketing Strategy 2025: Leading India’s Eco-Friendly Revolution

- P-TAL Marketing Case Study: Reviving India’s Timeless Craftsmanship

- Marketing Case Study: Rocca - Rising Above the Chocolate Crowd in India

- Unveiling What's Up Wellness Marketing Strategy: Key Tactics and Insights

- Lenskart Marketing Strategy 2025: AI, Content & Omni-Channel Success

- Ruban's Jewelry Marketing Strategy for Crafting Timeless Success in the Luxury Market

- Decoding iMumz’s Marketing Playbook: A Wellness Brand Built on Empathy

- Nish Hair Marketing Strategy: The Complete AIDA Playbook for D2C Success

Author's Note:

I’m Aditya Shastri, and this case study has been created with the support of my students from IIDE's digital marketing courses.

The practical assignments, case studies, and simulations completed by the students in these courses have been crucial in shaping the insights presented here.

If you found this case study helpful, feel free to leave a comment below.

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.