About Lakshmi Vilas Bank –

Source – Wikipedia

Source – Wikipedia

In 1926, the Karur, Tamil Nadu-based Lakshmi Vilas Bank was founded as a private sector institution in India. The bank had 566 locations as of November 2020, spread throughout 19 states and 1 union territory. The bank amalgamated with DBS Bank’s Indian business on November 27, 2020.

A group of seven Karur-based businessmen led by V. S. N. Ramalinga Chettiar created the Lakshmi Vilas Bank in 1926. Their goal was to meet the financial needs of those who worked in trade, industry, and agriculture in and around Karur. The Indian Companies Act, of 1913 was used to form the bank on November 3, 1926, and it received its certificate to open for business on November 10, 1926.

After the Banking Regulations Act of 1949 was passed and the Reserve Bank of India took over as the industry’s watchdog, the bank received its banking licence from the RBI on June 19, 1958, and on August 11, 1958, it was designated as a “scheduled commercial bank,” indicating that it could conduct business as a full-fledged commercial bank.

Lakshmi Vilas Bank offers services like –

- Commercial banking

- Financial services

- Insurance

- Investment banking

- Mortgage loans

- Private banking

- Retail banking

- Wealth management

Due to a “severe deterioration” in the company’s financial status, the Reserve Bank of India issued a month-long ban on Lakshmi Vilas Bank on November 17, 2020. The Reserve Bank of India published a statement in which it stated that Lakshmi Vilas Bank’s financial position was insufficient to pay off its depositors. A month-long ban was also announced, during which depositors may only withdraw a certain amount of money.

Quick Stats

| CEO | Subramanian Sundar |

| CMO | Sreejith Nair (marketing head) |

| Area Served | India |

| Industry | Banking/Financial services |

| Market Revenue | ₹2,558.03 crore (US$320 million) (2020) |

| Vision | To be a sound and dynamic banking entity providing financial services of excellence with Pan India presence |

| Tagline | The changing face of prosperity |

Marketing Strategy of Lakshmi Vilas Bank –

Let’s begin the case study on the marketing strategy of Lakshmi Vilas Bank revealing its STP Analysis because there are many aspects to take into account while creating the ideal marketing strategy.

Segmentation, Targeting and Positioning

Lakshmi Vilas Bank segments its services into Individual and Industry banking. This helps them to satisfy both Individual and Industry customers.

Lakshmi Vilas Bank targets Semi-urban and Rural banking.

Lakshmi Vilas Bank is positioned as the one that provides complete banking solutions.

Marketing Campaigns

- ‘Strong Heritage Smart Banking’ Campaign

In terms of branch presence, Tamil Nadu is the bank’s strongest market. To promote the merger of Lakshmi Vilas Bank and DBS Bank, the brand has been conducting a campaign named “Strong Heritage Smart Banking.” In the advertisement, Sachin Tendulkar interacts with consumers in the target market.

The campaign emphasises how crucial it is to find the perfect partner who can assist in overcoming obstacles in order to achieve objectives.

The Leo Burnett team conceptualised the campaign’s 360-degree brand communications, which include television, digital, and out-of-home (OOH) advertising components.

Social Media Marketing

Lakshmi Vilas Bank can be found on only LinkedIn and Twitter.

- LinkedIn: 19K followers

- Twitter: 2K+ followers

They are the most active and have a maximum number of followers on LinkedIn as a major part of their target audience is present on this platform.

They used to post promotional content about the services that are offered by banks and informational content on digital banking.

SEO Strategies

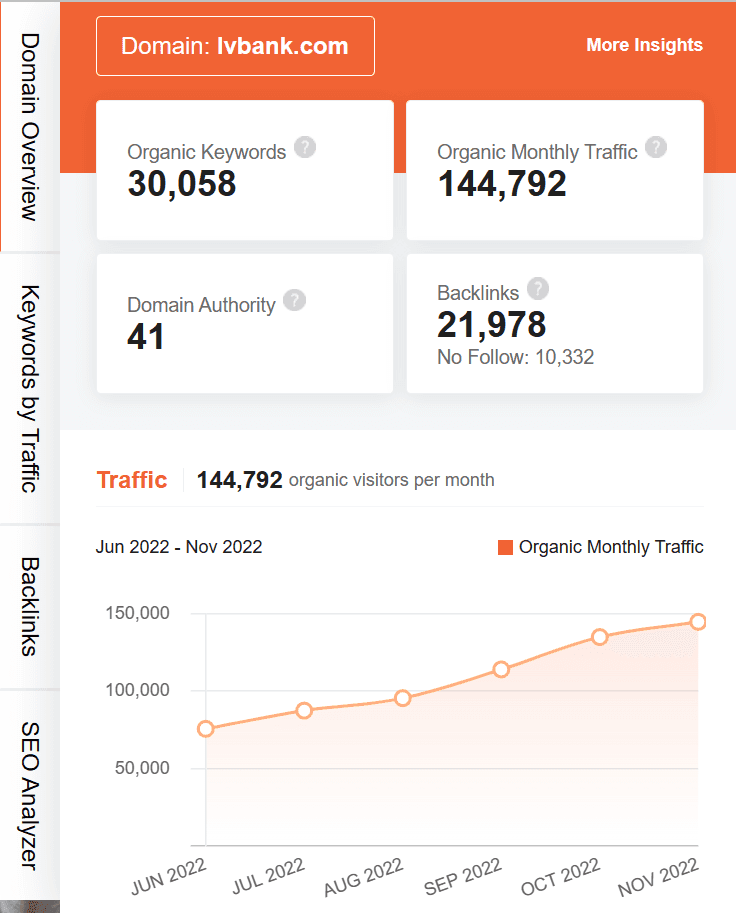

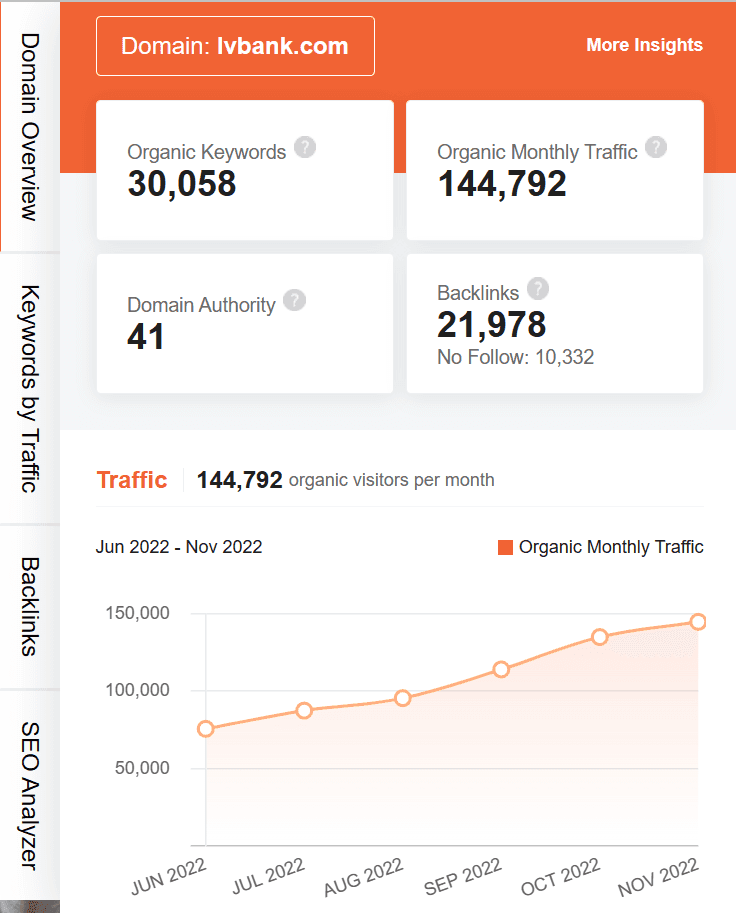

Source – UberSuggest

Source – UberSuggest

As per SEO Analysis, the Number of keywords – below 500 is bad, above 1000 is good, 10,000+ is amazing and as seen Lakshmi Vilas Bank has 30K+ organic keywords which are amazing.

Lakshmi Vilas Bank has 144K+ monthly visits which is impressive as above 20000 visits a month is considered good.

Influencer Marketing

Lakshmi Vilas Bank is now merged with DBS India. DBS is a known name in India. DBS has Sachin Tendulkar as their brand ambassador and he is seen in advertisements promoting the services that are offered at DBS Bank. He was also seen in the ad commercial which was made to announce the merger of DBS and Lakshmi Vilas Bank.

E-Commerce Strategies

As for E-Commerce when you click on any service on the website of Lakshmi Vilas Bank you are redirected to the DBS website on which you can get in detail information on the services provided. And it also guides you with further procedures on how to apply for services and how to use them.

Mobile Apps

Lakshmi Vilas Bank has a mobile app LVB DigiBank which helps you to use all the services offered by the bank with your mobile. This app has 5-star ratings and 50T+ downloads on Google Play Store. There is also an app by DBS bank digibank by DBS India which is available on the play store with that 4.1 ratings and 50L+ downloads.

Content Marketing Strategies

As for content marketing, they have a limited presence on social media and not much is published about the bank in blogs or articles. They usually only post about the multiple services provided by them on the website in detail.

This brings us to the end of the marketing strategy of Lakshmi Vilas Bank.

Source – Wikipedia

Source – Wikipedia

Source – UberSuggest

Source – UberSuggest