Updated on Aug 9, 2025

Share on:

Flipkart’s business model is built on low-cost, customer-centric services, and rapid innovation. This strategy allows them to offer affordable products while maintaining healthy profit margins. Flipkart achieves this by optimizing supply chains, leveraging fintech solutions, and scaling quick-commerce infrastructure. It uses its expansive logistics network and AI-driven personalization to streamline processes. But what’s the secret behind its market dominance?

Flipkart’s strong customer base and operational efficiency drive rapid market expansion and increased revenue. In this blog, we decode Flipkart’s revenue model and strategy, shedding light on how it has achieved consistent growth.

Curious about Flipkart’s secret sauce? Keep reading!

About Flipkart

Flipkart, founded in 2007 by Sachin and Binny Bansal, started as an online bookstore in India and quickly expanded into the country’s leading e-commerce marketplace. The company was acquired by Walmart in 2018, and its unique selling proposition (USP) lies in offering a vast product variety at competitive prices, with a strong logistics backbone via its delivery arm, Ekart.

As of 2025, Flipkart generates approximately ₹43,000 crore in revenue and has millions of active customers, with a dominant presence in urban and semi-urban India. Its key market success is attributed to its commitment to affordability, accessibility, and convenience. Flipkart has invested significantly in AI-driven personalization, ensuring a customized shopping experience, which enhances customer satisfaction.

The core philosophy of Flipkart is customer-centricity, focusing on making shopping easier, more accessible, and affordable for everyone in India. Customers experience fast deliveries, easy returns, and a seamless online shopping experience, which positions Flipkart as one of India's most trusted e-commerce platforms.

Flipkart’s secret to success lies in its ability to leverage technology, optimize logistics, and maintain strong partnerships with suppliers, giving it a competitive edge in the Indian e-commerce landscape.

Summary Table

| Feature | Details |

|---|---|

| Founded | 2007 |

| Founder | Sachin Bansal, Binny Bansal |

| Headquarters | Bengaluru, Karnataka, India |

| Industry | E-commerce, Retail |

| Revenue (2023) | ₹43,000 crore (approx.) |

| Presence | India (Urban & Semi-urban) |

| Employees | 30,000+ (estimated) |

| Popular for | Online retail, electronics, fashion, home essentials |

Learn Digital Marketing for FREE

How does Flipkart make money?

Revenue Stream Breakdown:

- Product Sales: Flipkart generates a significant portion of its revenue (~60%) through the sale of physical goods, including electronics, fashion, home essentials, and groceries.

- Advertising Revenue: Flipkart earns approximately 15% of its total revenue from sponsored listings and digital advertisements that appear on its platform.

- Subscription Fees: The Flipkart Plus membership program, which offers benefits like faster delivery, exclusive offers, and early access to sales, contributes around 10% of total revenue.

- Fintech Services: Flipkart’s fintech platform, super.money, which offers lending services, accounts for roughly 10% of its revenue.

- Logistics Services: Flipkart’s logistics arm, Ekart, generates about 5% of revenue by providing delivery services to third-party sellers.

Revenue Contribution:

- Product Sales contribute the largest portion (~60%) of Flipkart’s revenue, driven by a wide variety of physical products.

- Advertising Revenue makes up around 15%, providing a profitable income stream as brands pay for visibility.

- Subscription Fees account for about 10% through Flipkart Plus.

- Fintech Services and Logistics contribute smaller shares (~10% and ~5%, respectively), but these segments are crucial for Flipkart’s diversified revenue model.

Pricing Strategy:

Flipkart employs a low-cost pricing strategy, offering competitive prices for mass-market consumers.

This pricing approach helps the platform drive high sales volume, maintain a large customer base, and increase market share.

Additionally, the low-cost model supports advertising revenue by attracting sellers to advertise their products more frequently, as well as boosting Flipkart’s Fintech Services by expanding its user base.

The strategy positions Flipkart as an affordable and high-value marketplace in the competitive e-commerce space.

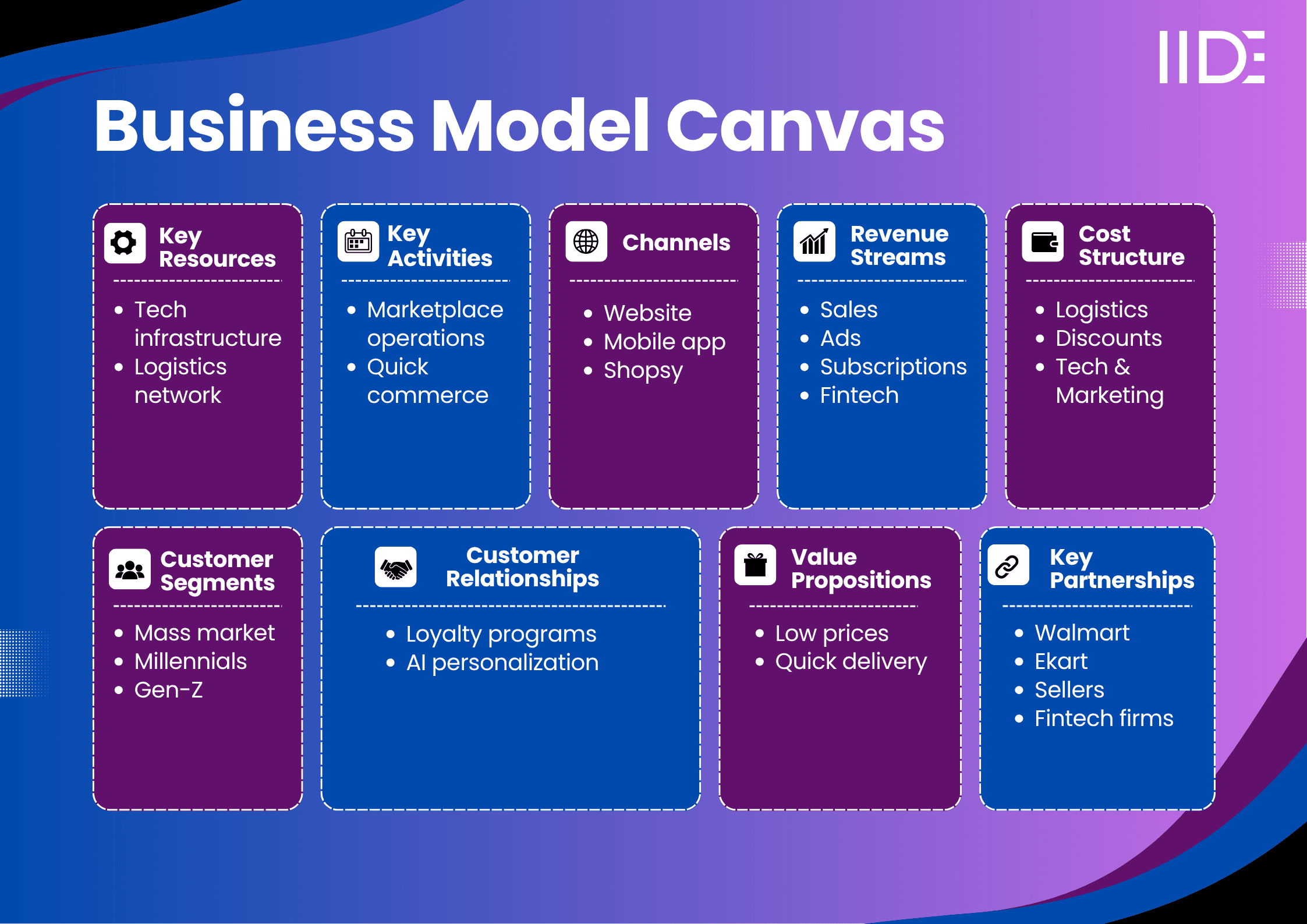

Flipkart Business Model Canvas

Flipkart Value Proposition

Flipkart’s unique value lies in its ability to combine affordability with ultra-fast delivery, catering to price-sensitive Indian consumers. Unlike typical e-commerce platforms, Flipkart addresses key customer needs by offering a wide range of products with fast, reliable service, thanks to its robust logistics and quick-commerce network, Flipkart Minutes.

The functional benefits include rapid order fulfillment, a seamless digital shopping experience, and AI-driven personalized recommendations. Customers experience pride and confidence by shopping with a brand known for offering competitive pricing and exceptional service.

On an emotional level, Flipkart connects with customers by providing convenience, reliability, and value, all of which contribute to brand loyalty. Its proprietary fintech solutions, like super.money, offer easy access to credit for both consumers and sellers, giving it a competitive edge few competitors can match.

Additionally, Flipkart’s innovative engagement strategies, such as video-commerce and social-commerce through Shopsy, address the underserved markets of tier-2 and tier-3 cities, which further cements its market dominance.

Flipkart Revenue Model

Flipkart generates revenue through a combination of product sales (~60%), advertising (~15%), and subscriptions (~10%).

The introduction of fintech lending services through super.money contributes around 10%, significantly enhancing profitability.

Flipkart’s logistics arm, Ekart, adds approximately 5% by offering services to third-party businesses.

The brand’s revenue is largely driven by online channels (~90%), in line with its digital-first strategy.

In 2024, Flipkart saw a 20-25% year-over-year revenue growth, fueled by fintech expansion and the scaling of quick-commerce services in key cities.

Flipkart Cost Structure

Major Expenses:

Flipkart’s key expenses include logistics, technology infrastructure, marketing, and employee compensation.

In FY24, logistics costs accounted for ₹6,230.6 crore, while technology and marketing expenses totaled around ₹4,720 crore combined.

Cost-Saving Strategies:

Flipkart optimizes costs through automation in fulfillment centers (85% automated), bulk procurement to reduce unit costs, and outsourcing logistics to third-party providers for efficiency.

Maintaining Healthy Margins:

Despite high logistics costs, Flipkart leverages economies of scale and advertising revenue (which grew by 51% in FY24) to maintain strong margins, estimated at 5-8%.

Flipkart Customer Segment

Flipkart operates on a B2C model, primarily targeting middle-income, urban, and semi-urban consumers aged 18-45.

It attracts tech-savvy millennials and Gen-Z users who seek affordable, fast delivery.

Shopsy extends Flipkart's reach to niche early adopters and digital-first customers in smaller cities.

Flipkart’s customers prioritize affordability, convenience, and seamless shopping experiences, with the brand offering products across various categories, including electronics, fashion, and groceries.

Distribution Channels of Flipkart

Physical Retail:

Flipkart does not operate physical stores but leverages third-party sellers and fulfillment centers to ensure efficient delivery.

Online Channels:

Flipkart operates through its mobile app and website, providing a seamless shopping experience with a broad product catalog.

Omnichannel or Digital-First:

Flipkart follows a digital-first approach, focusing primarily on its online platforms for sales and customer interaction.

Innovations in Distribution:

Flipkart uses features like automated checkouts and click-and-collect options to enhance operational efficiency and customer convenience.

Flipkart Key Partnerships

Flipkart partners with major players like Walmart, Ekart for logistics, and various fintech firms for its credit services through super.money.

Additionally, it collaborates with third-party sellers and regional distributors to expand market reach.

Flipkart’s partnerships with sustainability-focused NGOs promote eco-friendly initiatives like green packaging.

These strategic alliances contribute to operational efficiency, scaling the business, and aligning with Flipkart’s core values of affordability, accessibility, and sustainability.

SWOT Analysis of Flipkart:

| Strengths | Weaknesses | Opportunities | Threats |

| Walmart backing | Regulatory risks | Fintech expansion | Regulatory scrutiny |

| Robust logistics | High cash burn | Quick-commerce | Intense competition |

| Diverse offerings | Dependency on discounts | IPO potential | Margin pressures |

Flipkart Competitor Comparison

| Parameter | Flipkart | Amazon India | JioMart |

|---|---|---|---|

| Pricing | Low-cost, competitive | Premium pricing with discounts | Low-cost, competitive |

| Customer Experience | Fast delivery, AI personalization | Prime membership, fast delivery | Hyperlocal delivery, convenience |

| Channel Strategy | Digital-first, Shopsy (social commerce) | Hybrid (offline/online) | Omnichannel (local stores) |

| Market Focus | Mass market, Tier 2/3 cities | Premium, Metro cities | Local, grocery focus |

| Innovation | Quick-commerce, fintech | Cloud, Alexa integration | Local grocery delivery |

Want to Know Why 5,00,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 23, 2026

Duration

11 Months

Live & Online

Best For

Working Professionals

Mode of Learning

Online

Starts from

Mar 6, 2026

Duration

4-6 Months

Online

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.