Updated on Jan 7, 2026

Share on:

Hindustan Petroleum Corporation Limited (HPCL) is one of India’s most critical energy pillars, powering industries, households, and mobility across the country. But in 2026, as India pushes toward clean energy, EV adoption, and net zero goals, can HPCL balance profitability with transformation?

This SWOT Analysis of Hindustan Petroleum helps business students, entrepreneurs, and marketers understand how a legacy PSU adapts to disruption, regulation, and sustainability pressures and what strategic lessons it offers.

Before diving into the article, I would like to inform you that the research and initial analysis for this piece were conducted by Pranshu Ojha. He is a current student in IIDE's PG in Digital Marketing & Stategy Course, June Batch 2025.

If you find this helpful, feel free to reach out to Pranshu Ojha to send a quick note of appreciation for his fantastic research. He will appreciate the kudos!

About Hindustan Petroleum (HPCL)

Founded in 1974, Hindustan Petroleum Corporation Limited (HPCL) is a Maharatna PSU under the Government of India. Headquartered in Mumbai, HPCL operates across refining, marketing, and distribution of petroleum products. Its iconic slogan “Energising Lives” reflects HPCL’s mission to fuel India’s economic growth.

As of 2026, HPCL operates over 24,400 fuel stations and is aggressively investing in renewables, biofuels, and EV infrastructure.

| Particulars | Details |

|---|---|

|

Official Name |

Hindustan Petroleum Corporation Limited |

| Founded | 1974 |

| Headquarters | Mumbai, India |

| Ownership | Government of India (Maharatna PSU) |

| Industry | Oil & Gas, Energy |

| Operations | Refining, Marketing, Distribution |

| Revenue (FY24) | ₹4.6+ lakh crore |

| Employees | 9,000+ |

| Website | https://www.hindustanpetroleum.com |

| Key Competitors |

Indian Oil Corporation (IOCL), LPG, Bharat Petroleum Corporation Limited (BPCL), Reliance Industries Limited, Nayara Energy |

Why SWOT Analysis Matters for Hindustan Petroleum Now?

1. Changing Energy Landscape: India is targeting net zero emissions by 2070, pushing oil PSUs to rethink long term dependence on fossil fuels.

2. Rise of Electric Vehicles: EV adoption threatens traditional fuel demand, forcing HPCL to invest in charging stations and alternative fuels.

3. Volatile Crude Oil Prices: Global conflicts and supply shocks directly impact refining margins and profitability.

4. Government Regulations: Fuel price controls, subsidies, and ESG mandates significantly influence HPCL’s operations.

5. Sustainability Pressure: Investors and consumers now expect green energy transitions, not just fuel supply.

Learn Digital Marketing for FREE

SWOT Analysis of Hindustan Petroleum

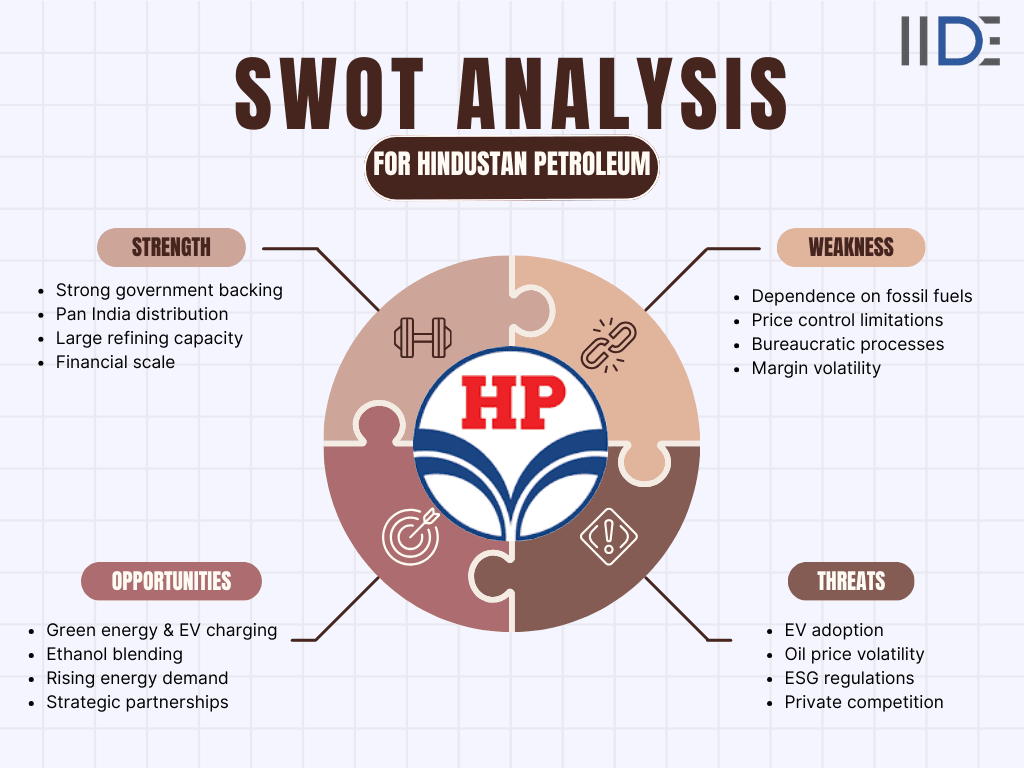

The SWOT analysis will evaluate Strengths, Weaknesses, Opportunities, and Threats affecting HPCL’s business model. It will reveal how HPCL leverages scale and government backing while managing energy transition risks.

Strengths of Hindustan Petroleum

1. Strong Government Backing

- Enables easier access to capital for large scale refinery and energy infrastructure projects

- Provides policy protection during fuel price freezes and subsidy driven market disruptions

- Strengthens investor confidence due to sovereign ownership and long term stability.

- HPCL enjoys strategic support from the Government of India, ensuring financial stability and policy alignment.

2. Extensive Distribution Network

- 21,000+ fuel stations across India

- Strong presence in urban & rural markets

- Integrated supply chain from refineries to retail

- Deep penetration in remote and underserved regions gives HPCL a logistical edge.

- Supports government fuel accessibility and last mile energy delivery

3. Robust Refining Capacity

- HPCL operates major refineries at Mumbai & Visakhapatnam

- The Vizag refinery expansion has significantly boosted capacity and efficiency.

- Higher refining complexity allows HPCL to process varied crude grades.

4. Diversified Energy Portfolio

- Beyond petrol and diesel, HPCL operates in blubricants, LPG, aviation turbine fuel & biofuels & ethanol blending.

5. Financial Scale

- In FY2024, HPCL reported ₹4.6 lakh crore+ revenue, reinforcing its position as one of India’s top PSUs.

- A large revenue base enables sustained capital expenditure on future energy projects.

- Strong balance sheet supports long term investments despite short term margin volatility.

- Economies of scale help absorb fluctuations in crude oil prices.

Weaknesses of Hindustan Petroleum

1. High Dependence on Fossil Fuels

- Despite diversification, core revenues still come from petrol and diesel, making HPCL vulnerable to energy transition shifts.

- Slower revenue diversification compared to private energy players.

- Long term demand risk as EV adoption and alternative fuels gain momentum.

- Increased exposure to climate related regulations and carbon reduction targets.

2. Government Price Controls

- Fuel pricing regulations limit HPCL’s pricing flexibility, impacting margins during high crude prices.

- Inability to immediately pass rising input costs to consumers.

- Margin compression during periods of global crude oil price spikes.

- Higher financial uncertainty during election cycles or policy driven price freezes.

3. Slower Decision Making

- As a PSU, HPCL often faces bureaucratic delays, reducing its agility compared to private players like Reliance.

- Limits rapid experimentation in new energy technologies and retail formats.

- Reduces competitive speed in fast evolving segments like EV charging and green fuels.

4. Refining Margin Volatility

- Gross Refining Margins (GRMs) fluctuate heavily due to crude price swings, global supply disruptions & currency volatility.

- High dependence on global geopolitical stability.

- Earnings unpredictability affects short term financial planning.

5. High Capital Expenditure

- Large investments in refineries and green energy strain short term profitability.

- Long gestation periods delay return on investment.

- Increased pressure on cash flows during expansion phases.

- Higher financial risk if energy transition timelines shift faster than expected.

Discover the marketing strategy of Hindustan Petroleum and how this energy giant is navigating India's transition to green energy.

Opportunities for Hindustan Petroleum

1. Renewable & Green Energy Expansion

- HPCL is investing in compressed biogas (CBG), green hydrogen, and solar & wind projects

- These initiatives align with India’s clean energy roadmap.

2. Electric Vehicle Infrastructure

- HPCL plans to install thousands of EV charging stations across highways and cities, opening new revenue streams.

- Leverages existing fuel station network for faster EV rollout.

- Enables cross selling through retail outlets and convenience stores.

- Creates an early mover advantage in public EV charging infrastructure.

3. Ethanol Blending Program

- India’s target of 20% ethanol blending by 2025 creates massive growth potential for HPCL’s biofuel operations.

- Supports government sustainability and farmer income initiatives.

- Reduces crude oil import dependence.

- Enhances long term fuel security for the company.

4. Strategic Partnerships

- Collaborations with startups, global energy firms, and state governments can accelerate innovation.

- Enables faster access to new technologies and alternative fuel expertise

- Reduces risk and capital burden through shared investments

- Strengthens HPCL’s presence in emerging energy ecosystems

5. Rising Energy Demand in India

- India’s growing middle class and infrastructure boom will sustain fuel demand in the medium term.

- Infrastructure led growth supports demand from the logistics and construction sectors.

- Aviation and industrial fuel consumption is expected to rise.

Threats to Hindustan Petroleum

1. Rapid EV Adoption

- Electric vehicles reduce long term fuel demand, posing structural risks to traditional revenue streams.

- Gradual erosion of petrol and diesel volumes in urban markets, especially among younger consumers.

- Increased risk of stranded fuel retail assets over time as footfall declines significantly.

- Requires accelerated diversification to offset demand loss and maintain competitive positioning.

2. Intense Competition

HPCL faces competition from:

- Indian Oil (IOCL) - largest network with scale advantages and government support.

- BPCL - aggressive expansion strategies with improved operational efficiency and customer focus.

- Reliance Industries (private, tech driven) - superior digital capabilities and innovative customer engagement models.

3. Global Oil Price Shocks

- Wars, OPEC decisions, and supply cuts directly impact profitability and operating margins significantly.

- Sudden crude spikes compress refining and marketing margins, eroding bottom line performance.

- Increases working capital requirements, straining liquidity and cash flow management capabilities.

- Creates uncertainty in financial forecasting, making strategic planning extremely difficult and unreliable.

4. ESG & Climate Regulations

- Stricter emission norms may increase compliance costs substantially across all operations.

- Higher capital expenditure is needed for cleaner technologies and sustainable infrastructure investments.

- Increased reporting and regulatory compliance burden requires dedicated resources and systems.

- Risk of penalties or operational restrictions if targets are missed or deadlines not met.

5. Private Player Efficiency

- Private firms operate with higher agility, better customer experience, and faster innovation cycles than PSUs.

- Faster decision making enables quicker market response to emerging trends and consumer preferences.

- Superior digital integration improves customer retention through personalized services and seamless experiences.

Get insights into the SWOT analysis of Bharat Petroleum and learn how BPCL is preparing for the future of energy retail.

IIDE Student Takeaway, Recommendations & Conclusion

Key Insight:

The biggest strength of HPCL is its scale and government backing, while the biggest risk is energy transition disruption.

Strategic Recommendations:

1. Accelerate Green Investments

- Establish hydrogen production facilities and distribution networks across major industrial corridors.

- Deploy EV charging stations at existing retail outlets to leverage real estate assets.

- Invest in solar and wind energy projects to diversify revenue beyond fossil fuels.

- Develop green hydrogen hubs for commercial vehicles and industrial applications.

- Partner with automakers for integrated EV charging solutions and bundled service offerings.

- Allocate significant capital budgets specifically earmarked for clean energy transition projects.

- Create dedicated business units focused exclusively on new energy technologies and innovation.

2. Customer Centric Retailing

- Launch integrated mobile apps with seamless payment, rewards tracking, and fuel management features.

- Develop tiered loyalty programs offering personalized discounts based on customer purchase behavior patterns.

- Transform fuel stations into experiential retail destinations with premium food and beverage options.

- Enable contactless payments, QR codes, and wallet integrations for faster transaction processing.

- Introduce subscription models for frequent users with predictable pricing and exclusive member benefits.

- Expand convenience store offerings to include fresh food, groceries, and lifestyle products.

- Use data analytics to understand customer preferences and tailor offerings to local demographics.

3. Operational Agility

- Streamline bureaucratic decision making processes to enable faster response to market changes.

- Implement performance based incentives tied directly to profitability and operational excellence metrics.

- Reduce excessive hierarchy layers to improve communication speed and accountability across organization.

- Empower regional managers with greater autonomy to make localized strategic and operational decisions.

- Adopt lean management principles to eliminate waste and optimize resource allocation efficiency.

- Invest in workforce training programs focused on digital skills and modern management techniques.

- Establish innovation labs and pilot programs to test new ideas rapidly without extensive approvals.

4. Global Partnerships

- Collaborate with Shell, BP, or TotalEnergies on advanced refining technologies and operational excellence.

- Study successful energy transition models from European companies navigating similar challenges and regulatory environments.

- Enter joint ventures for technology transfer in areas like carbon capture and green fuels.

- Participate in international consortiums focused on hydrogen infrastructure development and standardization efforts.

- Benchmark customer experience strategies against leading global brands in retail fuel markets.

- Engage consultants and advisors with deep expertise in energy transition and organizational transformation.

- Send leadership teams for immersion programs at innovative energy companies to observe best practices.

Future Outlook

If HPCL successfully balances profitability with sustainability, it can remain a dominant energy player even beyond fossil fuels.

Want to Know Why 2,50,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 23, 2026

Duration

11 Months

Live & Online

Best For

Working Professionals

Mode of Learning

Online

Starts from

Mar 6, 2026

Duration

4-6 Months

Online

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

You May Also Like

You May Also Like

HPCL competes with Indian Oil (largest network), BPCL (aggressive expansion), and Reliance (superior technology). While benefiting from government support and established infrastructure, HPCL lags in operational agility, digital innovation, and customer experience compared to private players.

Government support provides financial stability and policy advantages but also brings price controls limiting margins, bureaucratic processes slowing decisions, and potential political interference. HPCL must balance leveraging government support while building independent operational efficiency.

Digital transformation enables HPCL to improve customer experience through mobile apps and loyalty programs, optimize supply chain using data analytics, enable predictive maintenance, and compete with tech-savvy private players while reducing operational costs and enhancing customer retention.

ESG regulations require HPCL to invest in cleaner technologies, reduce emissions, and increase sustainability reporting. While raising short-term costs, these regulations drive innovation and long-term sustainability, helping attract responsible investors and build resilience against future climate risks.

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.