Updated on Dec 31, 2025

Share on:

PTT, a state-owned energy giant in Thailand, remains at the forefront in the Asian oil, gas, and renewable sectors in 2026. Ranging from upstream energy exploration to electric vehicle charging infrastructure, as well as investing in green technologies, PTT is setting the pace for the future energy landscape in the whole of Southeast Asia.

What is it, though, that makes PTT so different in 2026? Are sustainability requirements helping to unlock fresh opportunities, or are they ratcheting up the challenges facing PTT’s oil and gas businesses? How might aspiring entrepreneurs and students take inspiration from PTT’s changing approach?

This SWOT analysis distills complicated findings into easy-to-understand takeaways that you can use in business planning, marketing, learning from case studies, and more. Stay with us to learn how PTT is preparing for the future.

This blog is created in collaboration with Apoorva Parab, a student of IIDE's Online Digital Marketing Course, July 2025. Connect with Apoorva on LinkedIn in ou like her work. She will appreciate the applause.

About PTT

Founded in 1978, PTT Public Company Limited is Thailand's fully integrated national energy company involved in oil, natural gas, petrochemicals, EV ecosystems, and renewable energy. Its head office is in Bangkok, while PTT remains a vital factor in Thai economic development and also contributes to the energy security of the Southeast Asian region.

The slogan of this company is "Powering Life," which summarizes the mission powering industries, mobility, and communities while building a cleaner energy future.

Overview Table

| Metric | Details |

|---|---|

| Official Name | PTT Public Company Limited |

| Founded | 1978 |

| Headquarters | Bangkok, Thailand |

| Industries |

Oil & Gas, Petrochemicals, Retail Energy, Renewables, EV Ecosystem |

| Key Markets | Thailand, ASEAN, Global |

| Revenue (2024) |

~USD 78 billion (PTT Annual Report 2024) |

| Net Income (2024) | ~USD 3.5 billion |

| Employees | 25,000+ |

| Main Competitors |

Saudi Aramco, Petronas, Sinopec, Shell, Chevron |

Why Does SWOT Analysis Matter Now?

The global energy business is changing fast-and PTT must continue to innovate if it wants to remain competitive.

- Competitive Landscape: PTT is in competition with other legacy energy corporations such as Petronas and Aramco, renewable disruptors like Tesla Energy and BYD, and also rapidly growing green-tech startups.

- Shifting Consumer Preferences: Today, an increasingly large number of consumers and businesses in Asia favor greener energy, EV mobility, sustainable retail brands & smart energy solutions.

- Technology's Impact: Automation, AI-driven energy forecasting, carbon capture, and EV are in for rewriting the future course of energy.

- Economic Pressures: The fluctuating price of oil, inflation, and the trends of recession consequently affect PTT's revenues and the pattern of fuel consumption.

- Regulations & Sustainability: The governments are imposing stern laws on sustainability such as carbon reductions, clean‑energy mandates, plastic & pollution controls.

Learn Digital Marketing for FREE

SWOT Analysis of PTT

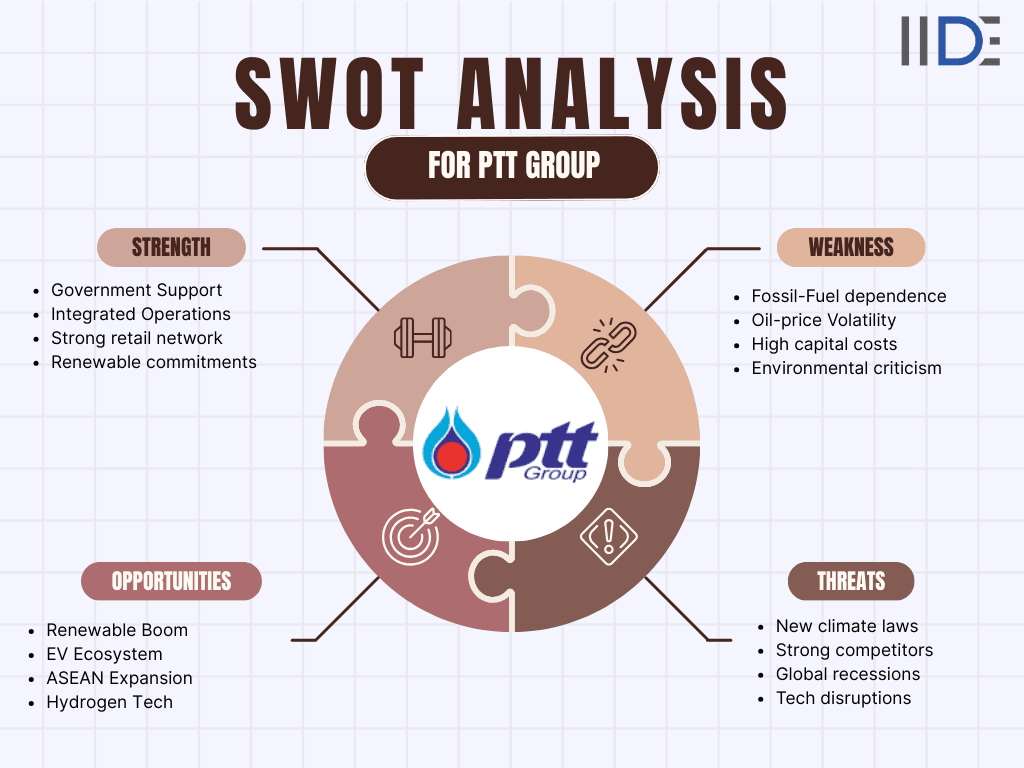

1. Strengths

This section highlights PTT's competitive advantages, structured as a numbered list of five pillars with subpoints for clarity and impact.

- Strong Government Support: Emphasizes PTT's state-owned status as a core strength, noting financial stability from government backing and its strategic national role that guarantees sustained demand.

- Totally Integrated Energy Value Chain: Details PTT's end-to-end control from upstream (exploration) to midstream (pipelines) and downstream (refining/marketing), which minimizes supplier risks through owned assets like pipelines and refineries.

- Accelerated Clean Energy Expansion: Focuses on PTT's ambitious sustainability goals, including a 12GW renewable energy target by 2030, with specific investments in solar, wind, biogas, and hydrogen to position it as a green energy leader.

- Powerful Retail Network: Spotlights PTT's extensive physical presence, boasting over 2,000 fuel stations and Café Amazon's 4,200+ outlets, establishing it as one of Asia's top coffee chains for diversified revenue.

- EV Growing Ecosystem: Outlines PTT's push into electric vehicles under the Arun Plus initiative, covering EV manufacturing, battery innovation/development, and charging station expansion to build a comprehensive mobility ecosystem.

2. Weaknesses

This section outlines PTT's key vulnerabilities, presented as a numbered list of four challenges with concise subpoints for emphasis.

- Heavy Reliance on Oil & Gas Revenue: Most of PTT's income derives from fossil fuels, creating vulnerability as global markets shift toward renewables.

- Environmental Concerns: Operations generate significant emissions, petrochemical waste, and broader ecological impacts that draw regulatory scrutiny.

- Exposure to Oil Price Volatility: Profitability remains dictated by unpredictable global energy markets, exposing the company to sharp financial swings.

- High Capital Expenditure: Large infrastructure projects demand huge long-term investments, straining resources amid economic uncertainties.

Deepen your PTT insights by exploring our detailed marketing strategy of PTT Group - uncovering innovative campaigns behind its retail empire and sustainable energy push.

3. Opportunities

This section highlights PTT's growth potential, structured as a numbered list of four key opportunities with expanded explanations for strategic depth.

- ASEAN Renewable Energy Boom: ASEAN's renewable surge by 2030 lets PTT double its capacity via solar and wind. This matches policy shifts for clean energy mandates and contracts. Early moves position PTT as a regional frontrunner.

- EV Charging Infrastructure: EV growth spikes demand for charging at PTT's 2,000+ stations under Arun Plus. Partnerships with automakers add battery tech and fast chargers. This builds a key mobility revenue stream.

- Expansion across Regions: Vietnam, Philippines, and Indonesia need LNG and renewables, suiting PTT's expertise. Acquisitions and ventures fill infrastructure gaps. This lifts PTT's global revenue by 2030.

- Hydrogen & Carbon Capture: Hydrogen and CCS investments align with net-zero targets using PTT's assets. They draw ESG investors and premium deals. PTT leads in blue hydrogen exports long-term.

4. Threats

This section details PTT's external challenges, structured as a numbered list of four threats with concise 3-sentence expansions.

- Tougher Climate Controls: Rising carbon taxes and emission caps hike PTT's operating costs amid global net-zero pushes. Compliance demands costly tech upgrades and fines for non-adherence. This squeezes margins on fossil fuel operations.

- Fierce Competition: Global giants like Shell and regional clean-tech startups erode PTT's market share in renewables. Aggressive pricing and innovation from rivals challenge PTT's dominance. Local players gain traction in ASEAN energy markets.

- Economic Slowdowns: Recessions cut fuel consumption and industrial demand, hitting PTT's core revenue. Reduced travel and manufacturing slow oil and gas sales. Recovery delays prolong financial pressures.

- Rapid Technological Disruption: Breakthroughs in batteries and green hydrogen favor agile competitors over PTT's legacy assets. Failure to adapt risks obsolescence in EV and clean energy. Market leaders seize shares from slower incumbents.

Discover our in-depth SWOT analysis of TotalEnergies - strengths, threats, and bold moves in the global energy shift.

IIDE Student Takeaway, Conclusion & Recommendations

PTT demonstrates financial strength and strategic positioning as Thailand's energy powerhouse, bolstered by its fully integrated value chain and national backing.

Renewables offer multi-billion-dollar opportunities amid the ASEAN green boom, yet intensifying competition and stricter climate regulations pose significant hurdles. Swift adaptation will determine if PTT leads the regional energy transition or lags behind agile rivals.

Key Recommendations

- Accelerate clean energy investments: Rapidly scale solar, wind, and hydrogen projects to hit 12GW renewables by 2030, securing government incentives and ESG funding.

- Expand EV infrastructure regionally: Leverage 2,000+ stations under Arun Plus for Southeast Asia-wide charging networks, partnering with automakers for battery tech and fast chargers.

- Enhance sustainability messaging: Launch transparent campaigns on emissions reductions and CCS tech to build consumer trust and attract global investors.

- Forge strategic alliances: Collaborate with ASEAN nations like Vietnam and Indonesia on LNG/renewables, plus international firms for hydrogen exports.

Final Thought

Can PTT pivot swiftly to dominate ASEAN's clean-energy revolution, or will regulatory pressures and rivals overtake it? The coming years will test its resolve.

Want to Know Why 2,50,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Post Graduate in Digital Marketing & Strategy

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 2, 2026

Duration

11 Months

Live & Online

Advanced Online Digital Marketing Course

Best For

Working Professionals

Mode of Learning

Online

Starts from

Feb 20, 2026

Duration

4-6 Months

Online

Professional Certification in AI Strategy

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Undergraduate Program in Digital Business & Entrepreneurship

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

Privatized in 2001 under the Corporatization Act, PTT listed on the Stock Exchange of Thailand in December 2001, raising significant capital while retaining state majority ownership.

PTT operates across upstream exploration, midstream pipelines, downstream refining/marketing, petrochemicals, retail (over 2,600 stations), and renewables like solar and EV charging.[

Under Arun Plus, PTT targets 12GW renewables by 2030, invests in hydrogen, carbon capture, and expands EV ecosystems to support Thailand's net-zero ambitions.

Beyond Thailand, PTT expands in ASEAN (Vietnam, Indonesia, Philippines) via LNG, renewables, and partnerships, alongside global exploration through PTTEP.

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.