Updated on Jan 5, 2026

Share on:

National Fertilizers Limited (NFL) has been a cornerstone of India's agricultural ecosystem for over five decades. As 2026 unfolds, examining the company's strategic position becomes crucial as sustainability and transformation reshape the sector.

This analysis examines NFL's competitive advantages, including government backing and distribution strength, internal challenges affecting profitability, growth opportunities in bio-fertilizers and exports, and external threats from private sector competition and regulatory changes.

Before diving into the article, I would like to inform you that the research and initial analysis for this piece were conducted by Neha Sharma. She is a current student in IIDE’s Online Digital Marketing Course, July Batch 2025.

If you find this helpful, feel free to reach out to Neha Sharma and send a quick note of appreciation for her fantastic research. She will appreciate the kudos!

About National Fertilizers Limited (NFL)

Founded on August 23, 1974, National Fertilizers Limited is a Navratna central public sector undertaking under India's Ministry of Chemicals and Fertilizers. Headquartered in Noida, Uttar Pradesh, NFL ranks as India's second largest urea producer.

The company operates five manufacturing facilities across Nangal, Bathinda, Panipat, and Vijaipur with an installed capacity of 3.57 million tonnes annually. In FY 2024-25, NFL reported revenues of ₹19,794.50 crores with a net profit of ₹183.98 crores, representing 22.61% growth year on year.

Quick Overview

| Attribute | Details |

|---|---|

| Founded |

Aug 23, 1974 |

| Status | Navratna PSU |

| Headquarters | Noida, Uttar Pradesh |

| Government Stake | 0.747 |

| Production Capacity | 3.57 million tonnes |

| FY 2024-25 Revenue | ₹19,794.50 crores |

| FY 2024-25 Net Profit | ₹183.98 crores |

| Market Position | Second largest urea producer |

| Market Share | 0.12 |

| Main Competitors | Coromandel, IFFCO, GSFC, Chambal |

Why SWOT Analysis Matters for NFL in 2026?

India's fertilizer sector faces significant shifts with volatile raw material costs, evolving subsidy frameworks, and increasing demand for sustainable inputs. The Union Budget 2025-26 allocated ₹1.65 lakh crores for fertilizer subsidies, highlighting both sector importance and government dependency.

A SWOT analysis reveals how NFL leverages advantages, where limitations exist, what opportunities await, and which risks pose threats.

SWOT Analysis of National Fertilizers (NFL)

National Fertilizers Limited operates where government policy, agricultural demand, and competition intersect. With approximately 12% market share, NFL maintains a significant presence despite increasing private sector competition. The core challenge is evolving from a subsidy dependent commodity supplier into an agile, technology enabled agricultural solutions provider within public sector constraints.

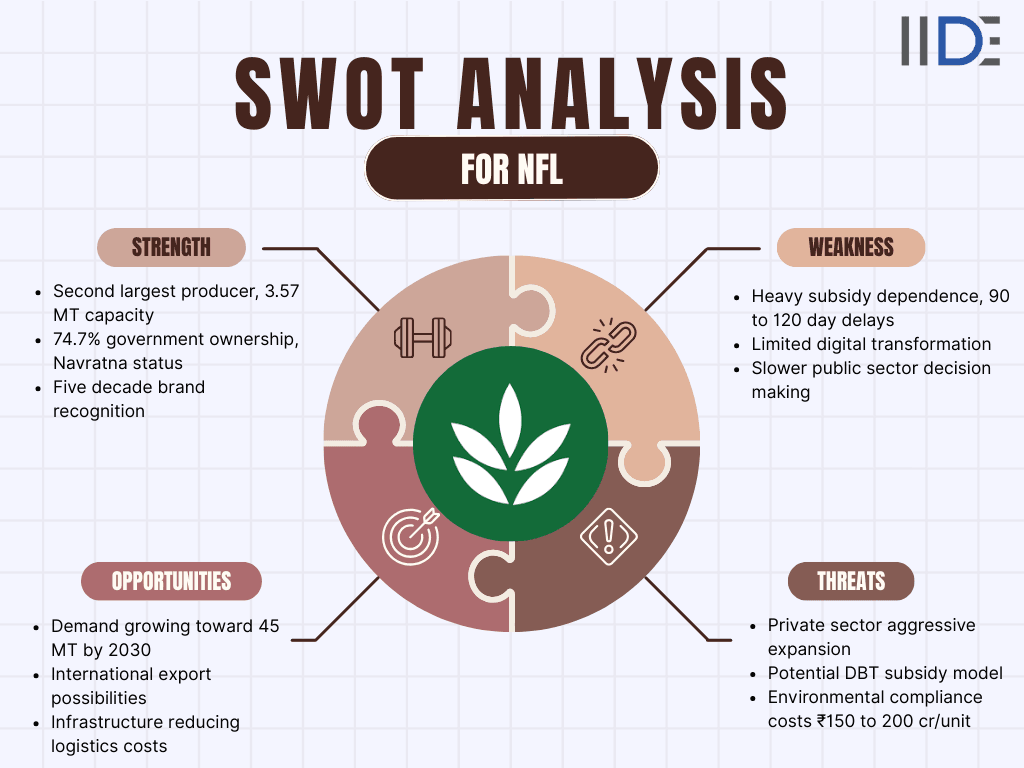

1. Strengths of National Fertilizers

- Strong Government Backing and Navratna Status: The Government of India holds 74.7% ownership, conferring Navratna status with operational advantages. NFL receives priority domestic natural gas allocations at subsidized rates, critical as gas comprises 70 to 75% of production costs. Despite industry challenges, NFL achieved 22.61% net profit growth in FY 2024-25.

- Established Market Presence: Holding 12% market share as India's second largest producer, NFL operates five strategically located plants across Punjab, Haryana, and Madhya Pradesh, ensuring coverage of key agricultural regions. Production scale enables bulk procurement advantages, reducing per unit costs.

- Diversified Product Range: Beyond chemical fertilizers, NFL manufactures bio fertilizers under the Sona brand and industrial chemicals, including nitric acid, ammonia, and ammonium nitrate. NFL also markets certified seeds under the Kisan Beej label, demonstrating portfolio diversification.

- Extensive Distribution Infrastructure: NFL's network encompasses 15,000+ retail points nationwide, supported by 52 regional marketing offices and 8 zonal offices. This infrastructure ensures product availability throughout India, including remote rural areas, a competitive advantage difficult for new entrants to replicate.

- Established Brand Recognition: Five decades of operations have made the NFL's KISAN brand well recognized across rural India. Government association adds credibility valued in agricultural communities. NFL maintains quality standards with defect rates below industry averages.

2. Weaknesses of National Fertilizers

- Heavy Subsidy Dependence: The NFL's model fundamentally relies on government subsidies. Urea sells at controlled prices significantly below production costs, with subsidies compensating the difference. Recent quarters saw subsidy payment delays extending to 90 to 120 days, forcing short term borrowing that increases interest costs and strains working capital.

- Persistent Profitability Challenges: Net profit of ₹183.98 crores on revenues of ₹19,794.50 crores translates to sub 1% net margin. Comparatively, Coromandel International achieved 7.4% net margins in FY 2023-24. Contributing factors include high energy costs, aging infrastructure, and public sector employment structures with operating costs exceeding industry benchmarks.

- Technology Adoption Lag: The NFL has been slower in implementing digital technologies and production automation. While competitors like Coromandel deploy AI driven predictive maintenance and digital farmer platforms, attracting millions of users, the NFL's technology integration remains incomplete. The mobile app, launched in 2023, has limited adoption.

- Operational Structure Constraints: Public sector ownership brings structural limitations affecting decision making speed and cost optimization. Strategic initiatives require multiple approval layers, including ministry consultations. Procurement processes governed by Government Financial Rules emphasize transparency, sometimes creating longer timelines during supply chain disruptions.

Dive into the marketing strategy of National Fertilizers to see how targeted farmer outreach and sustainable product branding fuel growth in India's competitive agri-input landscape.

3. Opportunities for National Fertilizers

- Growing Domestic Demand: Agricultural intensification and food security objectives ensure continued strong fertilizer requirements. Major consumption states like Punjab, Haryana, and Uttar Pradesh, where NFL maintains established networks, remain high demand regions. Eastern states show per hectare consumption 30 to 40% below national averages, indicating expansion potential.

- International Market Opportunities: Global fertilizer trade patterns shifted post 2022 as traditional exporters reduced outflows. The NFL has begun exploring exports with successful initial shipments to neighboring countries. African agricultural markets, growing at 5%+ annually, present substantial opportunities for strategic partnerships.

- Bio Fertilizer and Sustainable Agriculture: India's bio fertilizer market projects 11.5% CAGR growth toward ₹3,500 crores by 2028. NFL's pilot programs demonstrate how combining reduced chemical fertilizer with bio fertilizer supplementation achieves comparable yields with 30% lower chemical usage and 15 to 20% cost savings for farmers. The government allocated ₹1,500 crores for bio input promotion.

- Infrastructure Improvements: Ongoing rural infrastructure development progressively reduces supply chain costs. NFL anticipates 20 to 25% logistics cost reductions over the coming years as transportation networks improve. Expanding digital connectivity enables more direct farmer engagement through mobile applications.

- Strategic Partnerships: The NFL committed ₹572.75 crores toward a joint venture establishing a new Ammonia Urea Plant in Namrup, Assam. Such partnerships enable capacity expansion and technology access while sharing capital requirements. Agricultural technology startups offer collaboration opportunities for demand forecasting and inventory optimization.

4. Threats to National Fertilizers

- Intensifying Market Competition: Private companies have expanded aggressively with new capacity additions expected to be operational by 2026-27. These competitors demonstrate superior efficiency, with Coromandel achieving 7.4% net margins versus NFL's sub 1%. Leading private players maintain millions of active app users receiving comprehensive agricultural services beyond fertilizer transactions.

- Subsidy Policy Uncertainty: Government subsidy mechanisms represent NFL's largest operational risk. Industry reports indicate the ministry considers Direct Benefit Transfer models for urea subsidies, potentially creating significant cash flow implications. Subsidy payment delays extended in recent quarters, necessitating increased short term borrowing with higher interest costs.

- Unpredictable Input Costs: Natural gas, comprising 70 to 75% of production cost, makes NFL highly vulnerable to energy price volatility. International LNG prices demonstrated extreme fluctuation, with recent spikes to $18+ per mmBtu during geopolitical tensions. Global ammonia prices surged over 40% in 2024, forcing higher procurement costs.

- Stricter Environmental Regulations: Emission standards revised in 2024 mandate 30% NOx reduction by December 2026, requiring investments estimated at ₹150 to 200 crores per unit for older facilities. The National Green Tribunal imposed stricter groundwater usage limits. Proposed carbon pricing mechanisms could add ₹30 to 50 per bag to production costs.

- Evolving Agricultural Practices: Precision agriculture technologies enable 20 to 30% fertilizer reduction while maintaining yields. As technology costs decline, adoption accelerates, particularly among younger farmers. Younger farmers, projected to constitute 40% the farming population by 2030, demonstrate different purchasing behaviors, preferring digital channels where NFL maintains a limited presence.

Explore the SWOT analysis of Rashtriya Chemicals and Fertilizers to uncover its robust production strengths and market leadership alongside vulnerabilities to raw material volatility and regulatory shifts.

IIDE Student Takeaway

- National Fertilizers Limited embodies the tension between public sector stability and commercial competitiveness.

- As India's second largest urea producer with government backing, NFL possesses foundational advantages.

- However, the profitability gap of sub 1% net margins versus competitors' 7%+ reveals pressing operational challenges.

- The fundamental tension lies in the NFL's dual role of fulfilling public welfare objectives while competing commercially.

- Government ownership provides support but constrains operational flexibility. Heavy subsidy dependence creates vulnerability to policy changes directly impacting cash flows.

- NFL's success depends on its transformation capabilities. Bio fertilizer opportunities are growing at a 11.5% CAGR, and sustainable agriculture trends align with global shifts.

- The ₹572 crore Assam joint venture demonstrates strategic intent. Yet capitalizing requires operational agility NFL has historically found challenging.

Recommendations

- Accelerate Digital Transformation: Implement comprehensive supply chain digitization and launch an integrated farmer engagement platform. Target 40% farmer digital adoption by 2028. Investment of ₹200 to 250 crores over 18 to 24 months.

- Scale Bio Fertilizer Production: Expand pilot programs nationwide, leveraging ₹1,500 crore government allocation. Position bio fertilizers as premium offerings. Target 15 to 20% revenue from bio inputs by 2029.

- Strategic Export Development: Build on Bangladesh export success to establish multi year contracts in 3 to 4 countries across South Asia and Africa. Target 500,000 tonnes of annual exports by 2028.

- Infrastructure Modernization: Prioritize ₹600 to 800 crore investment in the oldest production units, focusing on energy efficiency and emission reduction through technology partnerships.

- Margin Improvement Initiative: Launch comprehensive cost optimization targeting a minimum 2% net margins by FY 2027-28 through energy efficiency, process automation, and strategic procurement.

Conclusion

National Fertilizers Limited stands at a pivotal moment. The company maintains market presence, government support, and distribution reach, providing genuine advantages. The 22.61% net profit growth in FY 2024-25 demonstrates underlying resilience.

However, long term relevance requires transformation beyond incremental improvements. The industry evolves rapidly with private competitors gaining ground through superior margins, digital platforms, and operational agility. The NFL must embrace technology, improve profitability, and gradually reduce subsidy vulnerability while preserving its public sector identity.

The opportunities ahead are substantial, including expanding demand, bio fertilizer growth, international markets, and strategic partnerships. The NFL possesses the foundation. Now, execution agility determines whether the company thrives as a competitive leader or merely survives on government support.

The question isn't survival but relevance. Can the NFL evolve into the agricultural solutions partner India's farmers increasingly need?

Learn Digital Marketing for FREE

Want to Know Why 2,50,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 2, 2026

Duration

11 Months

Live & Online

Best For

Working Professionals

Mode of Learning

Online

Starts from

Feb 20, 2026

Duration

4-6 Months

Online

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

You May Also Like

NFL produces Neem-coated urea, bio-fertilizers (solid and liquid in four strains), Bentonite Sulphur, and industrial items like ammonia, nitric acid, ammonium nitrate, sodium nitrite, and sodium nitrate.

The company trades imported non-urea fertilizers, certified seeds, agrochemicals, city compost, and other inputs via its dealer network under the 'KISAN' brand.

NFL operates five gas-based ammonia-urea plants at Nangal and Bathinda (Punjab), Panipat (Haryana), and two at Vijaipur (Madhya Pradesh).

NFL offers soil testing via 6 static and 2 mobile labs, farmer education on fertilizer use, and initiatives like seed multiplication programs.

NFL is a Navratna public sector undertaking under the Ministry of Chemicals and Fertilizers, with the Government of India holding the majority stake since 1974.

As India's second-largest urea producer with 16.5% market share, NFL sold over 54 LMT of fertilizers in 2021-22 through its extensive zonal and area offices.

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.