Updated on Jan 6, 2026

Share on:

Horlicks has been a household name in India’s nutritional drink category for decades. In 2024-25, under Hindustan Unilever Ltd (HUL), Horlicks remained one of the leading players in malt-based/functional nutritional drinks. But as consumer preferences evolve, rising health awareness and competition increase it's vital to reassess Horlicks’ strengths and vulnerabilities.

This SWOT analysis helps entrepreneurs, marketers, and students understand where Horlicks stands and what lies ahead for this legacy brand.

Before diving into the article, I would like to inform you that the research and initial analysis for this piece were conducted by Prathamesh Deshpande. He is a current student in IIDE's Online Digital Marketing Course, June Batch 2025.

If you find this helpful, please reach out to Prathamesh Deshpande to send a quick note of appreciation for his fantastic research. He will appreciate the kudos!

About Horlicks

Horlicks was originally developed in 1873 by British brothers William and James Horlick. Its journey in India began post-World War I, when returning soldiers introduced it as a nutritional supplement. Today, Horlicks under HUL is one of India’s most trusted nutritional-drink brands, known for its fortified malt-milk formulations and multi-generational appeal, making it highly relevant in 2025-26.

| Attribute | Details |

|---|---|

| Official Name | Horlicks |

| Founded | 1873 (global origin) |

| Parent Company (India) | Hindustan Unilever Ltd (HUL) |

| Industry |

Functional Nutritional Drinks/ Malt-based beverages |

| Key Markets/Geography |

Pan-India, strong in South & East India; exports to 20+ countries |

|

Approximate Annual Revenue (India) |

₹3,000-₹3,500 crore (recent estimate) |

|

Market Share (HFD/Malt Beverages in India) |

45-50% as of 2025 |

| Main Competitors |

Other malt-based/nutritional drinks e.g. from competitor beverage brands. |

Learn Digital Marketing for FREE

SWOT Analysis of Horlicks

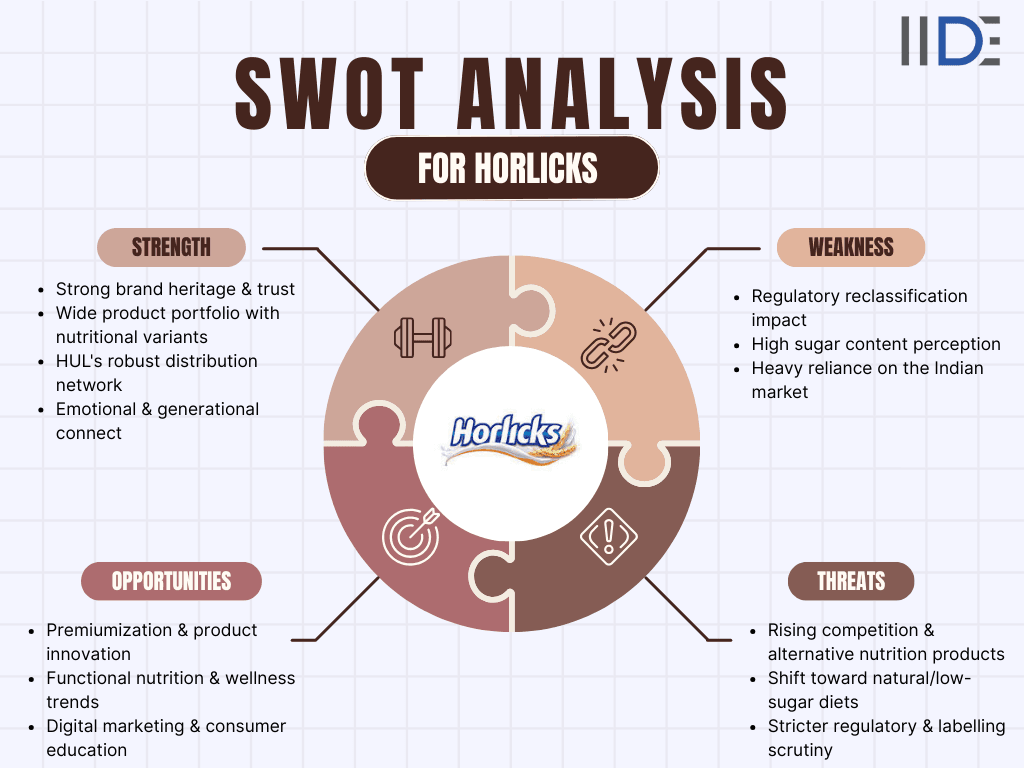

Horlicks remains one of India’s most trusted nutritional-drink brands, backed by over a century of heritage and strong emotional connection across generations. Its greatest strengths lie in its powerful brand equity, high market share, and the distribution muscle of Hindustan Unilever (HUL), which ensures deep penetration across India.

However, the brand faces notable weaknesses especially around regulatory reclassification, increasing scrutiny of sugar content, and a traditional perception that may not appeal to younger, modern health-conscious consumers.

Looking ahead, Horlicks has major opportunities in premium nutrition, such as protein-rich, low-sugar, adult-oriented, and women-focused variants. Growing health awareness in rural India and rising demand for functional nutrition also open new avenues for expansion.

At the same time, Horlicks must stay cautious of threats from new-age nutrition brands, clean-label trends, and tightening advertising regulations in the health-drink category.

This SWOT analysis highlights the key factors that Horlicks must navigate to maintain and grow its market presence while addressing emerging challenges.

1. Strengths of Horlicks

- Strong brand heritage & trust: Horlicks has been around since 1873 globally, and for decades in India. That legacy lends tremendous brand equity and consumer trust across generations.

- Wide product portfolio & nutritional value: Horlicks offers multiple variants (Classic, Chocolate, specialized mixes) fortified with essential nutrients targeting children, women, or general wellness.

- Strong distribution/fresh reach under HUL: Since acquisition by HUL in 2020, Horlicks leverages HUL’s massive distribution network, supply-chain, and marketing capability helping it remain widely available across India, even in smaller towns.

- Market leadership & high share: As of 2025, Horlicks commands about 45-50% value share in malt-based/functional nutritional drinks in India making it the category leader.

- Emotional & generational connect: For many Indian families, Horlicks is more than a drink it symbolizes nourishment, childhood memories, and care. This emotional bond supports customer loyalty and repeats use.

2. Weakness of Horlicks

- Regulatory & categorization changes: In 2024, HUL reclassified Horlicks from “health drink” to “functional nutritional drink” following regulatory guidance requiring shifts in marketing claims and possibly affecting perception.

- Perception issues around sugar and health consciousness: As consumers become more health-conscious, concerns about sugar content or processed drinks may affect Horlicks’ positioning as a wholesome beverage.

- Heavy reliance on Indian market: Much of Horlicks’ revenue comes from India; this dependency makes it vulnerable to economic fluctuations, regulation changes, or shifts in domestic consumer behaviour.

- Brand image somewhat “traditional”: While legacy helps, it can also backfire younger urban consumers may view Horlicks as an “old-school” drink, potentially preferring newer nutrition/health-focused alternatives.

From product innovation to pricing strategy - discover the marketing success of the super drink in our comprehensive Marketing Mix of Horlicks analysis.

3. Opportunities for Horlicks

- Premiumisation & product innovation: As consumers demand more protein-rich, low-sugar, adult-oriented nutritional drinks Horlicks can leverage its brand trust to launch premium/specialized variants (e.g. protein-forward, women’s nutrition, immunity-boosting formulas). Several analysts expect this segment to grow.

- Deeper penetration in rural and semi-urban India: With HUL’s vast distribution reach, Horlicks can tap markets where awareness of nutrition is rising but access to fortified drinks is still limited. This offers substantial growth potential.

- Functional nutrition & wellness trends: As the health-and-wellness wave grows globally and in India, Horlicks can position itself as part of a balanced diet fortified with vitamins/minerals especially for kids, adolescents, pregnant women.

- Digital marketing & consumer education: With increasing internet penetration, HUL can use digital campaigns, doctor endorsements, and community outreach to rebuild trust about nutrition benefits, transparency, and usage targeting younger, more discerning consumers.

4. Threats to Horlicks

- Rising competition & alternative nutrition solutions: Health-drinks competitors (other malt beverages), and newer alternatives protein powders, plant-based drinks, ready-to-drink nutrition shakes threaten Horlicks’ dominance.

- Changing consumer preferences toward low sugar (natural diets): As more consumers shift to clean eating and natural food sources, processed malt drinks like Horlicks may lose appeal. Rising awareness around sugar or processed ingredients may deter some users.

- Regulatory & labelling scrutiny: Regulatory changes that prompted reclassification in 2024 could lead to stricter norms on health claims, advertising, and product labelling potentially restricting marketing-led advantages.

- Perception risk in younger demographics: Younger consumers millennials and Gen Z may view malt-based drinks as outdated or “for kids,” reducing long-term brand relevance unless Horlicks successfully rebrands for modern lifestyles.

Want to know what's working for Milo and what challenges it's facing? Check out our SWOT analysis of Milo to see how this popular drink is handling competition, health trends, and changing customer tastes in today's market.

IIDE Student Takeaway, Conclusion and Recommendation

Horlicks continues to stand strong as a trusted nutrition brand with deep emotional value in Indian households. Its long-standing legacy, diverse product range, and the powerful backing of HUL give it a solid foundation for continued growth.

However, the brand also faces real challenges especially around evolving health perceptions, sugar-related concerns, and the rising popularity of modern, clean-label nutritional solutions.

Recommendations

1. Develop Low-Sugar Variants: Horlicks needs to reformulate products with reduced sugar content to align with modern health consciousness. Consumers today are increasingly wary of high sugar intake, especially for daily-consumed beverages. Creating options that deliver the same nostalgic taste but with healthier sweetening alternatives could attract health-focused families and younger demographics.

2. Create Protein-Rich Products: The market is seeing huge demand for high-protein nutrition. Horlicks should introduce variants that emphasize protein content for muscle building, recovery, and satiety. This positions the brand not just as a comfort drink but as a functional nutrition solution for fitness enthusiasts and active lifestyles.

3. Refresh Brand Image: The brand needs a visual and messaging makeover to shed its old-fashioned image. Modern packaging, updated advertising campaigns, and repositioning from "childhood nostalgia" to "contemporary wellness" will help attract younger consumers while retaining loyal customers.

4. Embrace Digital-First Consumer Behaviors: Invest heavily in e-commerce, social media marketing, influencer partnerships, and direct-to-consumer channels. Younger consumers discover and purchase products online, so Horlicks needs strong digital presence, engaging content, and seamless online shopping experiences to stay competitive.

Now, the question is: Can Horlicks reinvent itself for the next generation of health-conscious consumers while maintaining the trust built over the past century?

Want to Know Why 2,50,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 2, 2026

Duration

11 Months

Live & Online

Best For

Working Professionals

Mode of Learning

Online

Starts from

Mar 6, 2026

Duration

4-6 Months

Online

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

You May Also Like

It does contain added vitamins, minerals, and nutrients that can supplement your diet. However, it also has sugar, so it's best consumed in moderation as part of a balanced diet rather than as a replacement for whole foods.

Hindustan Unilever Limited (HUL) acquired Horlicks in India in 2020. Globally, the brand has different owners in different regions.

They have Classic, Chocolate, Women's Horlicks (with added calcium and iron), Junior Horlicks for toddlers, and specialized nutrition versions. Each targets different age groups and nutritional needs.

In 2024, due to regulatory changes, HUL reclassified it as a "functional nutritional drink" instead of a "health drink." This was to comply with food regulations around health claims and labeling.

It depends on what you're looking for. Horlicks has strong brand trust and decent nutrition, but newer alternatives might have less sugar or more protein. Compare labels based on your specific needs.

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.