Orginally Written by Aditya Shastri

Updated on Jan 6, 2026

Share on:

With its iconic tagline, "Get the Future you Want" Capgemini has emerged as a global leader in technology services, consulting, and digital transformations. For more than 50 years, Capgemini, one of the most reputable technology and consulting partners, has inspired businesses to reinvent their futures.

The brand is still a powerful force in 2026, but it works in a world where the consulting industry is changing due to new sustainability regulations, AI disruption, and economic uncertainty.

What, then, is driving Capgemini's current worldwide prominence and what might affect it in the future?

Let's examine Capgemini's SWOT analysis, which was designed for both academic and practical decision-making.

Before diving into the article, I would like to inform you that the research and initial analysis for this piece were conducted by Ritika Garg. She is a current student in IIDE's Online Digital Marketing Course, June Batch 2025.

If you find this helpful, feel free to reach out to Ritika Garg to send a quick note of appreciation for her fantastic research, she will appreciate the kudos!

About Capgemini

Capgemini is a multinational French company, founded in 1967 with its headquarters located in Paris, France. Serge Kampf co-founded it and it has since grown into a leading provider of digital services, technology, and consultancy. As of 2024, Capgemini is known for assisting customers in accelerating their sustainable and digital transformation.

The company which employs more than 340,000 people worldwide, is heavily involved in data services, cloud computing, and artificial intelligence. Capgemini reported €22,096 million in revenue in 2024.

| Attribute | Details |

|---|---|

| Official Name | Capgemini SE |

| Founder | Serge Kampf |

| Year Founded | 1967 |

| Headquarters | Paris, France |

| No. of Employees | 341,100 (2024) |

| Industry |

IT Services, Consulting, Digital Transformation |

| Global Presence | ~50 countries |

| 2024 revenue | €22,096 million |

| Competitors | Accenture, TCS, Deloitte, IBM, Cognizant |

What does SWOT stand for in Capgemini’s case?

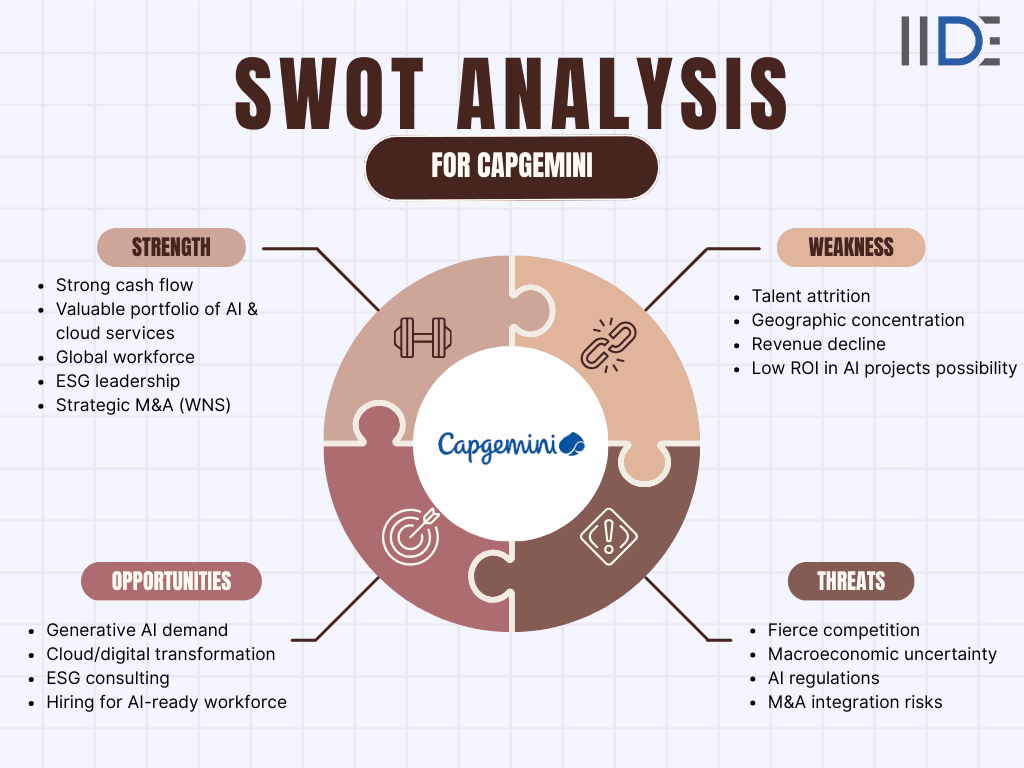

SWOT stands for strengths, weaknesses, opportunities and threats. For Capgemini, it helps analyze the company’s expertise, areas of internal difficulty, external opportunities it can take advantage of, and market threats that could hinder its growth.

Why SWOT Analysis Matters Capgemini in 2026?

- Market shifts with AI: AI, cloud and automation influence is rapidly transforming the consulting and IT sectors approach.

- Financial volatility: Client spend affected by adverse global economic conditions is making it critical to assess Capgemini’s adaptability.

- Sustainability integration: Capgemini’s sustainable approach in both its operations and its services is a crucial strategy with ESG (environmental, social, governance) becoming a global movement.

- M&A Activity: Big moves like Capgemini's acquisition of WNS (~$3.3B) may significantly accelerate its Agentic AI-powered Intelligent Operations.

Learn Digital Marketing for FREE

SWOT Analysis of Capgemini

A SWOT Analysis helps assess the strengths, weaknesses, opportunities and threats forming Capgemini’s position in the global consulting and IT services market. This assessment is key to understanding how the business leverages its resources, deals with internal issues, and reacts to rapidly evolving technologies and competitive demands. We can learn a lot about Capgemini's plan for maintaining growth and leadership in digital transformation by examining its position in 2026.

Strengths of Capgemini: How the Innovation-Driven IT Giant Leads in 2026

Capgemini enters 2026 with solid competitive advantages of a strong global workforce, stable financial performance, and deep expertise in AI, cloud, and digital engineering. These advantages allow the business to consistently innovate for customers across industries, maintain a robust operating model, and complete high-value transformation projects.

1. Robust Financial Base & Cash Flow

- Capgemini demonstrated a strong liquidity by generating €1,961 million in organic free cash flow representing its financial stability even during the difficult market in 2024.

- Every year the group demonstrated a strong resilience by maintaining a stable operating margin of 13.3%.

2. Wide Range of High-Quality Services

- Capgemini is shifting toward high-value, innovation-led services, cloud, data & AI, intelligent supply chain, generative AI.

- Generative AI is becoming a real driver: in Q4, generative AI projects brought about 5% of bookings.

3. Global Workforce & Delivery Model

- More than 340,000 workers worldwide, including a sizable offshore base (As of 2024 figures, 58% workforce).

- Capgemini gets its flexibility, cost advantages, and global reach with such large scale force.

4. Leadership in ESG & Sustainability

- Capgemini aims to reduce 90% of its absolute carbon emissions across scopes 1, 2 and 3 by 2040 compared to 2019.

- Renewable sources are the major contributors for nearly 98% of its electricity usage (as aligned with its RE100 target).

- Capgemini helps its clients reduce their IT carbon footprint by using green IT solutions like eco-design and reduced infrastructure to cut cloud costs.

- By having 37% of the women workforce, the company is also focusing on improving gender diversity (2024).

5. Strategic M&A Moves

- To reinforce its business process services, particularly intelligent operations powered by AI, Capgemini has acquired WNS.

- By 2027, this transaction may result in cost savings as well as revenue synergies.

Weaknesses of Capgemini: Challenges the Tech Leader Faces in 2026

Capgemini faces internal challenges like high employee turnover, European markets dependency, and uneven revenue growth in unpredictable economic times despite its size and potential. Delivery capacity, margin stability, and the company's ability to seize new digital opportunities could all be impacted by these difficulties.

1. Revenue Decline & Soft Macro Conditions

- At constant exchange rates, revenue dropped 1.9% year-over-year in 2024 as a result of tighter client budgets and delayed technology spending across key markets.

- As Q1 revenues fell 3.3%, indicating cautious customer behaviour in the face of uncertain global economic conditions, the slowdown became more apparent in early 2024.

- Guidance for 2026 is still cautious. Capgemini predicts 2.0-2.5% growth at constant currency as of Q3 2026.

- Such macro-driven softness puts further strain on margins and growth momentum and has an impact on new deal pipelines, particularly in industries like manufacturing and retail.

2. Risk of Geographic Concentration

- Europe, particularly France, accounts for a sizable amount of Capgemini's income. The company's total performance is closely linked to the state of the local economy.

- In 2024, for overall growth, the manufacturing sector was the particular dragging force in France.

- Over-reliance on a single region limits diversification and compromises revenue stability by making it more susceptible to local slowdowns.

3. Talent Attrition & Recruitment Costs

- The cost of replacing and retraining employees have increased as Capgemini faces high attrition in its IT services.

- The company experiences more pressure to draw in and retain top talent due to the rapidly increasing demand for specialised skills in AI, cloud, data, and cybersecurity.

- Particularly in large transformation engagements, frequent turnover can affect delivery quality and interfere with project continuity.

4. ROI Risk in AI Projects

- The business must carefully choose use cases to steer clear of low-value or inefficient implementations as the CEO of Capgemini pointed out that not every AI project yields a positive ROI.

- This can cause project setbacks or client dissatisfaction if not managed well.

Dive into our comprehensive SWOT analysis of TCS to uncover the strategic strengths, weaknesses, opportunities, and threats shaping India's IT giant's future dominance in the global tech landscape.

Opportunities for Capgemini: Growth Potential for the Digital Pioneer in 2026

As businesses prioritise sustainable and future-ready operations, increased cloud investments, and accelerated AI adoption, Capgemini has significant growth prospects in 2026. These prospects have the potential to enhance the company's value across industries and broaden its global reach.

1. Escalating Demand for AI & Generative AI

- With Capgemini already seeing traction thanks to an increase in GenAI project bookings, a significant growth opportunity is created by the quick adoption of generative AI.

- The company is well-positioned to lead significant enterprise transformation initiatives due to its strong experience in AI, data, and cloud.

- Capgemini's intelligent operations portfolio is strengthened by the WNS acquisition, which is consistent with the move towards automation-driven business models and Agentic AI.

2. Cloud & Digital Transformation Growth

- Businesses are continuing to make significant investments in hybrid cloud architectures, cloud migration, and application modernisation.

- Co-delivery of high-impact digital solutions is made possible by Capgemini's solid alliances with leading cloud providers (AWS, Microsoft, Google).

- The demand for automation, smart manufacturing, and sustainable engineering is driving the rapid growth of its Intelligent Industry vertical.

3. Sustainability & ESG Services Development

- Capgemini can expand consulting in green transformation, carbon reduction, and sustainable IT as ESG becomes central to business strategy.

- Businesses are looking for partners with robust internal sustainability policies, which boosts Capgemini's reputation.

- Long-term growth potential is created by the need for climate-focused digital solutions and energy-efficient operations.

4. AI-Ready Workforce & Talent Expansion

- Expansion of AI, cloud, and digital engineering capabilities is made possible by Capgemini India’s extensive hiring plans in 2026

- The capacity to deliver next-generation transformation initiatives is increased by an AI-ready workforce.

- Capgemini's global delivery model is strengthened and innovation is supported by investments in new talent and skill development.

Threats For Capgemini: Obstacles Impacting Growth and Stability in 2026

Despite Capgemini's strong global hold, a number of external threats could affect its long-term growth, performance, and competitiveness. Knowing these risks aids in determining how the business must change to remain resilient in a rapidly evolving digital environment.

1. Increasing Competitive Pressures

- Consulting and IT giants like Accenture, IBM, TCS, and Deloitte compete fiercely with Capgemini, putting pressure on prices and cutting margins.

- Capgemini's market share may be limited by rapid increase of competitors into AI, cloud, and digital transformation services.

- Businesses that develop quickly may surpass Capgemini in obtaining high-value deals due to rapid innovation cycles.

2. Market & Economic Uncertainty

- Clients may postpone or reduce IT and consulting expenditures due to a macroeconomic downturn, particularly in Europe.

- Pressure from difficult market conditions is reflected in Capgemini's cautious revenue forecast.

- The flow of new deals and significant transformation initiatives can be affected due to budget tightening across industries.

3. Geopolitical & Regulatory Hazards

- Due to its global reach, Capgemini is susceptible to shifting guidelines, data governance regulations, and regional geopolitical strain.

- Capgemini’s development and implementation of generative or agentic AI solutions may be impacted by

- Europe's increasingly stringent AI and digital sovereignty regulations.

- These regulatory demands could affect client interactions, raise compliance costs, and delay project completion.

4. Risk of M&A Execution

- Integration risks are associated with the WNS acquisition as any misalignment could lessen anticipated synergies and benefits.

- In the coming term, margins may be impacted by integration costs and cultural mismatch.

- Inadequate execution may affect client delivery and postpone the acquisition's intended value.

Explore our in-depth SWOT analysis of Accenture - unlock strategic insights for your business edge today!

Capgemini's robust global delivery methodology, reliable client connections, and capacity to carry out challenging digital transformation projects at scale are just a few of its noteworthy capabilities. These attributes help the organisation maintain stability and trust across multiple industries.

However, it faces various disadvantages, such as uneven regional performance, increased talent-related pressures, and the operational difficulty of responding quickly in a fast-changing technology ecosystem.

Looking at opportunities, by improving its AI and cloud-led products, increasing its footprint in high-demand markets, and utilising its engineering and sustainability expertise to enable next-generation corporate solutions, Capgemini can accelerate growth.

On the threat side, the corporation must handle severe rivalry, economic uncertainty, and developing global policies that influence tech adoption. Rapid innovation cycles also mean Capgemini must always invest to stay ahead.

IIDE Student Insights, Strategic Recommendations & Capgemini's Prospects for 2026 and Beyond

Through Capgemini's SWOT analysis, the company still stands competitive and well-positioned, supported by solid finances, a sizable global workforce, and in-depth expertise of AI, cloud, and digital transformation. It has a strong advantage in the quickly changing IT services market thanks to its capacity to provide large-scale, high-value solutions across industries.

However, significant obstacles to Capgemini's long-term growth include the slowdown in important European markets, increased talent attrition, and mounting pressure to show quantifiable ROI from AI investments.

Biggest Advantage vs. Biggest Risk:

- Advantage: With the acquisition of WNS, it made a bold move into AI and intelligent operations that might completely change its growth trajectory.

- Risk: If AI initiatives don’t provide strong ROI, or if macro conditions worsen, Capgemini could experience margin pressure.

Core Tension: Although Capgemini's technological potential and operational scale reinforce its leadership, the company's heavy reliance on Europe and the challenges of new AI deployments raise concerns about client satisfaction, revenue stability, and margins.

Future Outlook: Capgemini needs to make significant investments in talent development, accelerate its diversification outside of Europe, and keep expanding its AI and cloud offerings in order to improve its competitive position. Long-term value creation will depend on how well its high-impact AI projects are executed and how well the significant acquisitions, like WNS, are integrated.

Future precedency for Capgemini will be shaped by sustainability, digital sovereignty, and responsible AI, as multinational corporations expect that technology partners combine innovation with ethics, trust, and environmental impact.

Recommendations:

- Double down on AI use-case validation: Build frameworks to measure value for clients and concentrate on AI projects with demonstrated ROI.

- Leverage ESG credentials: In order to secure ESG transformation deals, Capgemini should aggressively market its sustainability expertise.

- Strengthen integration strategy for WNS: Ensure cultural alignment and clear governance to realise synergies.

- Invest in talent retention: Offer career paths, upskilling (especially in AI/cloud), and retain critical technical talent.

- Flexibility in guidance & cost control: Be prepared to expand when demand returns while keeping a cautious financial perspective.

Conclusion

Capgemini's SWOT analysis sheds light on the company’s current position indicating at a significant turning point in the global IT services sector. With strong skills in AI, cloud, and digital engineering, along with a well-established delivery strategy, the company is ready to manage the next wave of enterprise transformation.

Yet it must negotiate issues such as regional revenue slowdowns, mounting personnel influenc, and the increasing demand for high-ROI AI solutions.

As Capgemini advances towards 2026, its ability to responsibly scale AI, diversify regionally, and integrate big acquisitions will play a decisive role in shaping future performance.

Its long-term positioning is further strengthened by its growing emphasis on talent development, intelligent operations, and sustainability.

To summarise, Capgemini is well-positioned to continue being a top partner for digital transformation across industries if it keeps adjusting to market changes while utilising its core competencies.

Want to Know Why 2,50,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 23, 2026

Duration

11 Months

Live & Online

Best For

Working Professionals

Mode of Learning

Online

Starts from

Mar 6, 2026

Duration

4-6 Months

Online

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

You May Also Like

Capgemini is a global consulting and technology services company. They help businesses with digital transformation, cloud solutions, AI implementation, and IT consulting.

They're headquartered in Paris, France, but operate worldwide with offices in over 50 countries.

Pretty much all of them! Banking, retail, healthcare, manufacturing, energy, telecom - you name it. They're quite diverse in their client base.

They're one of the biggest players in IT consulting, with over 340,000 employees globally as of recent counts.

Capgemini focuses heavily on technology and digital transformation, whereas some competitors might lean more toward management consulting or specific niches.

Yes, Capgemini is significantly investing in AI, generative AI, automation, and data engineering, collaborating with enterprises like AWS, Microsoft, and Google to create enterprise-grade AI solutions.

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.