Updated on Sep 15, 2025

Share on:

In our last blog, we did an end-to-end SWOT analysis of one of the strongest contenders in the private banking sector, HDFC. In this blog will be doing a detailed SWOT Analysis of Barclays.

It is the largest bank in the United Kingdom by total assets and also the 2nd largest bank by market capitalization. It is one of the most valued banks in the United Kingdom with a brand value of about $10 billion.

In this growing digital era, one of the most crucial parts is to make a good digital presence on which Barclays has done a good effort. But still, there are some places where it can improve on. With the use of advanced digital marketing skills, it can fix these flaws. Having knowledge of digital marketing is one of the most helpful tools for businesses nowadays. If you want to know what is digital marketing and how to use it to your advantage – check out our Free MasterClass on Digital Marketing 101 by the CEO and Founder of IIDE, Karan Shah.

Thus this makes us anxious to know how Barclays grew its success in the industry. In this blog, we have done an elaborated SWOT Analysis of Barclays. But before we start with its SWOT Analysis let us first know about Barclays as a company, its services, competitors, financials, and more.

About Barclays

A British multinational universal bank established in 1690 which has a worldwide high reputation – Barclays has its headquarter in London and is known for all its firsts to credit, machines, funding from more than 300 years of history whether it’s the funding for the world’s first industrial steam railway in 1819, to introducing the world’s first automated teller machine in 1967.

Barclays with more than 325 years of history and aptitude in banking, works in more than 40 nations and utilizes roughly 83,500 individuals.

Barclays is a constituent of the FTSE 100 Index which has a primary listing on the London Stock Exchange and has a secondary listing on the New York Stock Exchange. It is appraised as a systemically significant bank by the Financial Stability Board.

Barclays generated a revenue of about $30 Billion as of 2020, and a net income of more than $4 Billion. It has a market capitalization of more than $44 Billion as of 2020.

Quick Stats About Barclays

| Founders | John Freame and Thomas Gould |

|---|---|

| Year Founded | 1690 |

| Origin | London |

| No. of Employees | 83,500 (2020) |

| Company Type | Public |

| Market Cap | $44 Billion (2020) |

| Annual Revenue | $30 Billion (2020) |

| Net Profit | $4 Billion (2020) |

Services of Barclays

Barclay is one of the largest companies in the Uk and over the world. It provides its customers with different services to keep them satisfied. Following are some of Barclays services:

- Corporate Banking

- Insurance

- Investment Banking

- Mortgages

- Wealth and Investment Management

Close Competitors of Barclays

Barclays provides its services all over the world. Thus this brings a large amount of competition for it. Below are some of the top competitors for Barclays:

- National Westminster Bank.

- Lloyds Bank.

- The Co-operative Bank.

- Santander UK.

- Deutsche Bank.

- Commerzbank.

Now that we got an idea about the company let us start with the elaborated SWOT Analysis of Barclays.

SWOT Analysis of Barclays

SWOT Analysis helps the leaders of the organization to devise an essential arrangement plan following the internal and external component factors of the organization.

The main purpose of SWOT analysis is to identify the strategies that can be used to build on & protect Barclay’s strengths and eradicate its weaknesses both of which are the internal factors of the company whereas to exploit its external factors such as its opportunities and counter market threats.

Let us understand its SWOT analysis by starting with the Strengths of Barclays.

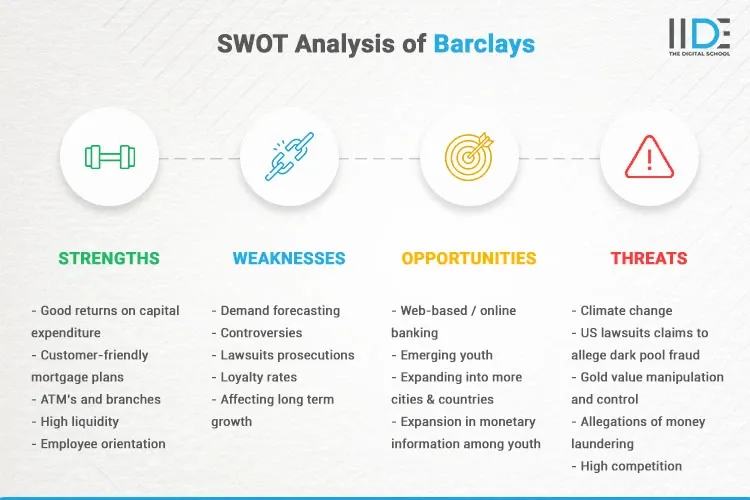

1. Strengths of Barclays

Strengths are the positive factors of Barclays. These help it stay above other competitors. Following are some of the Strengths of Barclays:

- Good Returns on Capital Expenditure – Barclays is known for its execution of new projects and also for good returns on capital expenditure by building new revenue.

- Customer-friendly Mortgage Plans – It offers 80 different mortgage plans to its customers which last for two, three, five, or 10 years with impressive interest rates as compared to other banks.

- ATM’s and Branches – Barclays bank has more than 4700+ department branches, 1600 offices in the UK, and operates in over 55 nations. It is a part of the global ATM partnership that allows its customers to withdraw from banks without paying any extra charges as a premium for other bank’s ATMs.

- High Liquidity – It is a fully capitalized bank with high liquidity and cash flow, which allows resources to intensify into new and unique projects around the globe.

- Employee Orientation – The significant and effective systems of learning and training their employees by professional trainers. Barclays spends heavily on the recruitment and the development of its employees, contributing and looking for a workforce that is highly trained and driven to bring great evolution.

2. Weaknesses of Barclays

The weaknesses are the regions where Barclays can improve. These are the factors that affect a companies growth. It should be aware of such factors and tackle them as soon as possible. Following are some weaknesses of Barclays:

- Demand Forecasting – One reason why the day’s stock is in high contrast with its rivals is that Barclays isn’t that good at request anticipating along these lines wind up keeping higher stock both in-house and in the channel.

- Controversies – Debates like financing of government in Zimbabwe and violating international money laundering laws affected the brand image of Barclays.

- Lawsuits prosecutions – Cases like Involvement with South Africa under politically sanctioned racial segregation, allegations of tax evasion, and so forth have influenced the brand picture.

- Loyalty Rates – It has been rated very low by its users. This is a negative factor for the company which needs to change as soon as possible.

- Affecting Long Term Growth – Days stock inventory is in high contrast with the opponent adversaries – making the organization raise more cash flow to put resources into the channel. This can affect the long term development of Barclays

3. Opportunities for Barclays

These are those factors that help Barclays grow in the industry. It should be able to capture such opportunities and make them their strengths. Following are some of Barclays Opportunities:

- Web-based / online banking – Venturing into web-based banking is a gigantic undiscovered region. New clients from online channels – Over a couple of years, the organization has put a tremendous amount of cash into the internet-based stage. This venture has opened a new deals channel for Barclays. In the accompanying, very few years the association can utilize this possibility by knowing its customer better and serving their necessities using tremendous data examination.

- Emerging Youth – there is a buzz in the youth nowadays for investment and they are searching for different investment alternatives. Barclays can acquire metropolitan youth searching for investment alternatives.

- Expanding into more cities & countries – Barclays right now works in more than 50 nations and utilizes 156,000 representatives. It can fill further in large numbers of its current business sectors. Developing business sectors offer the bank openings for additional development. Working in new geological areas is likewise worth investigating.

- Expansion in monetary information among youth – As training levels are improving, there will be an ascent in the number of young people who are searching for venture choices. Barclays as of now has a solid brand review among youth, on account of being the English Premier League support. It should utilize this review to tap the youth right toward the beginning of their venture excursion and expect to hold them as steadfast clients throughout a significant stretch

4. Threats to Barclays

Lawful difficulties are additionally considered dangers. For example, The Serious Fraud Office (SFO) in the UK has accused Barclays Bank PLC of ‘unlawful monetary help’ identified with billions of pounds brought from Qatar up in 2008. Barclays holds a financial permit that permits it to work in various nations. In any case, if the bank was seen as blameworthy, it could lose that critical permit (BBC, 2018).

- Climate change – In 2017 Barclays confronted fights by tree huggers because of its responsibility for Third Energy which intended to remove natural gas utilizing hydraulic pressure driven braking (deep earth drilling) at Kirby Misperton in Yorkshire. Then in 2020, they sold off its Third Energy to Alpha Energy. Barclays put $85 billion in petrol fuel extraction and $24 billion being developed.

- US lawsuit claims to allege dark pool fraud – In June 2014 the US province of New York documented a claim against the bank asserting it cheated and deluded financial backers with off base showcasing material with regards to its unregulated exchanging framework known as a dim pool. The bank’s offers dropped 5% on information on the claim.

- Gold value manipulation and control – In May 2014 the Financial Conduct Authority fined the bank £26 million over frameworks and controls disappointments, and irreconcilable situations with the bank and its clients in association with the gold fixing during the period 2004–2013, and for control of the gold cost on 28 June 2012.

- Allegations of money laundering – In March 2009, Barclays paid US$298 million to settle the allegations of violating and disregarding worldwide illegal tax avoidance laws.

- High Competition – A profoundly competitive and aggressive environment from various other banks can affect the conflict marked share of Barclays bank.

With this, we have completed the SWOT Analysis of Barclays. This study helps Barclays to know its internal and external factors better and make changes accordingly in the business.

Learn Digital Marketing for FREE

Conclusion

On the study on the SWOT Analysis of Barclays, we know that it is one of the largest banks in the United Kingdom. It provides good returns on capital expenditure and customer-friendly mortgage plans. It also has large opportunities in the youth as knowledge of financial investment is growing. Even with such advantages, it has some flaws in the market.

Its involvement in controversies and low loyalty rates make a breach in the brand’s image. The large competition in the market also affects the company at large. These factors can be overcome by implementing proper strategies like improving its online reputation and making a better brand reputation. These come under advanced digital marketing skills which are very important in this digital age. If you are interested in learning and upskilling, check out IIDE’s 3 Month Advanced Online Digital Marketing Course to know more.

If you would like to read such detailed analyses of companies, find more such insightful case studies on our IIDE Knowledge portal.

Thank you for taking the time to read this, and do share your thoughts on this case study in the comments section below.

Want to Know Why 2,50,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Post Graduate in Digital Marketing & Strategy

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 2, 2026

Duration

11 Months

Live & Online

Advanced Online Digital Marketing Course

Best For

Working Professionals

Mode of Learning

Online

Starts from

Feb 6, 2026

Duration

4-6 Months

Online

Professional Certification in AI Strategy

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Undergraduate Program in Digital Business & Entrepreneurship

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.