Orginally Written by Aditya Shastri

Updated on Dec 11, 2025

Share on:

Bajaj Finance's business model is built on offering consumer loans, insurance, and wealth management products, combined with a robust digital infrastructure. This strategy allows them to provide accessible financial solutions while maintaining high profit margins. Bajaj Finance achieves this through its strategic partnerships, technology-driven operations, and focus on customer service.

About Bajaj Finance

Bajaj Finance, established in 1987 by Bajaj Finserv, is one of India’s leading non-banking financial companies (NBFCs), offering a range of financial products such as personal loans, consumer durable loans, and insurance. It operates with a customer-centric approach, leveraging technology to offer tailored solutions. The company has seen significant growth, with revenues reaching INR 23,000 crore in 2023, and boasts over 50 million customers. With a strong presence across India, Bajaj Finance is known for its digital-first approach and innovative solutions, making it a leader in the financial sector.

| Feature | Details |

|---|---|

| Founded | 1987 |

| Founder | Bajaj Finserv |

| Headquarters | Pune, India |

| Industry | Financial Services |

| Revenue (2023) | INR 23,000 crore |

| Presence | 50+ million customers |

| Employees | 40,000+ |

| Popular for | Personal loans, insurance, and wealth management |

Learn Digital Marketing for FREE

How does Bajaj Finance make money?

1. Revenue Stream Breakdown:

- Product Sales: Personal loans, consumer durable loans, insurance policies, and wealth management services contribute to significant revenue

- Subscription Fees: Recurring revenue comes from fees related to customer accounts and credit facilities

- Services: Bajaj Finance generates income from its financial advisory and insurance services

2. Revenue Contribution:

Product sales contribute 70% of Bajaj Finance’s total revenue, with personal loans and consumer durable loans being the highest contributors.

3. Pricing Strategy:

Bajaj Finance primarily follows a value-based pricing model, offering competitive interest rates on loans to attract a mass-market customer base while ensuring profitability.

The SWOT analysis of Bajaj Finserv complements understanding of Bajaj Finance, providing deeper insights into its parent company's strategies and market positioning.

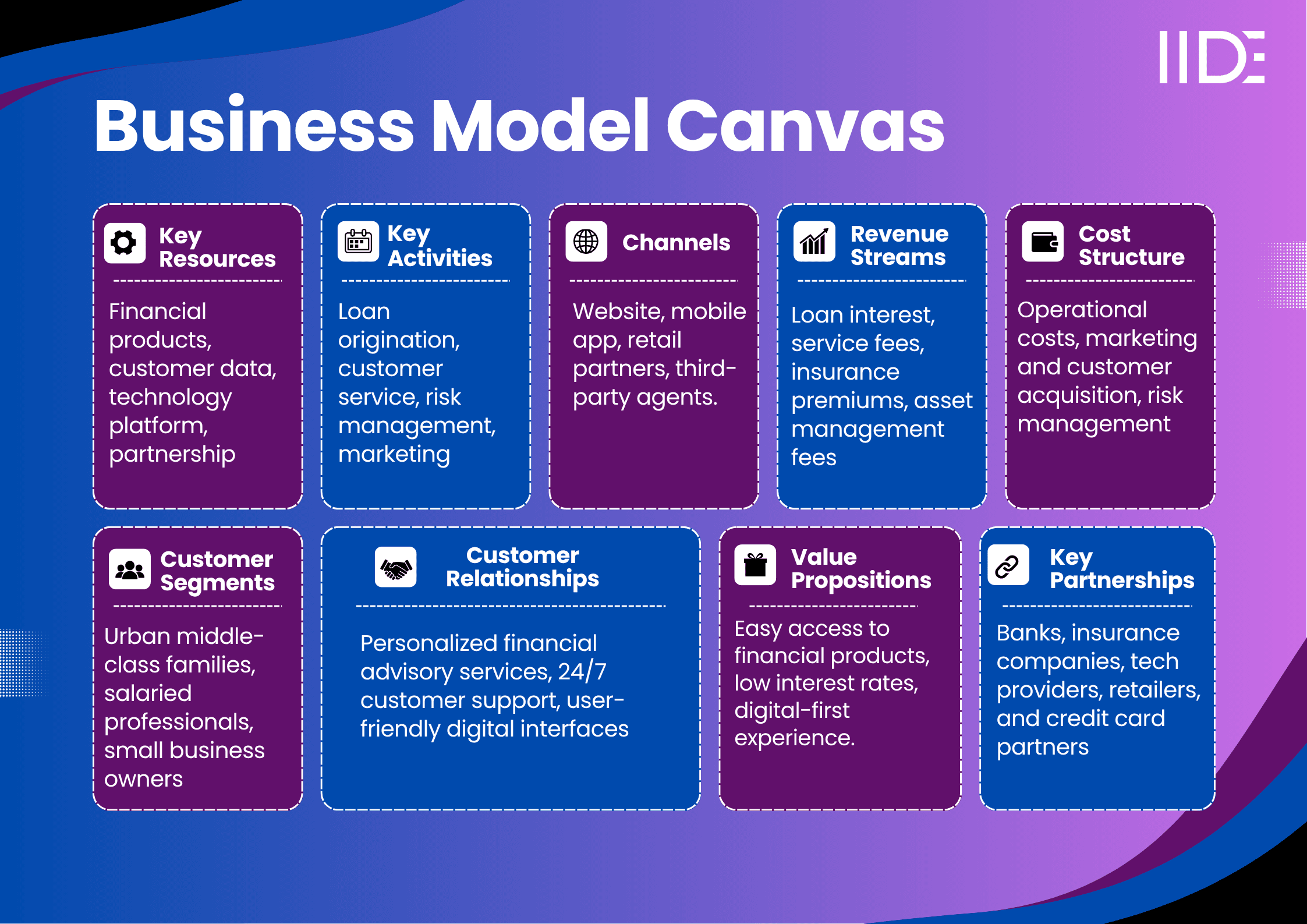

Bajaj Finance Business Model Canvas

Bajaj Finance Value Proposition

Bajaj Finance offers an unparalleled customer experience by providing flexible, easy-to-access financial solutions such as personal loans, credit cards, and insurance, all backed by advanced technology. The brand’s key appeal lies in its customer-first approach, offering low-interest loans and robust digital interfaces, making financial products more accessible. Bajaj Finance differentiates itself through innovative offerings like easy EMIs and tailored financial advice, allowing customers to manage their finances with ease.

Bajaj Finance Value Proposition

Bajaj Finance offers an unparalleled customer experience by providing flexible, easy-to-access financial solutions such as personal loans, credit cards, and insurance, all backed by advanced technology. The brand’s key appeal lies in its customer-first approach, offering low-interest loans and robust digital interfaces, making financial products more accessible. Bajaj Finance differentiates itself through innovative offerings like easy EMIs and tailored financial advice, allowing customers to manage their finances with ease.

Bajaj Finance Customer Segment

Bajaj Finance targets the middle-class segment in India, focusing on consumers aged 25-50, predominantly urban-based. It offers products for individuals seeking easy loan options for consumer durables, personal loans, and insurance. The company also caters to small businesses requiring financing solutions for growth and expansion, serving both B2C and B2B customers with a strong digital-first approach.

Distribution Channels of Bajaj Finance

Bajaj Finance operates both physical and digital distribution channels. Its omnichannel strategy includes a robust online presence via its mobile app and website, and it also partners with retail outlets and third-party agents to offer in-store financing options. The digital-first approach ensures a seamless customer experience, further augmented by innovations like instant loan approvals and mobile-friendly interfaces.

Bajaj Finance Key Partnerships

Bajaj Finance’s key partnerships include collaborations with banks, insurance companies, retail chains, and tech providers. These partnerships enable Bajaj Finance to offer a wide range of financial products to customers. Strategic collaborations with technology providers help improve digital services and customer acquisition processes, while alliances with retailers allow for a seamless, integrated financing experience for customers.

SWOT analysis of CarMax highlights consumer financing innovations that resonate closely with Bajaj Finance’s customer-centric approach.

SWOT Analysis of Bajaj Finance

| Strengths | Weaknesses | Opportunities | Threats |

|---|---|---|---|

| Digital-first approach | High dependency on loans | Expanding into new markets | Competition from banks |

| Strong brand equity | Customer acquisition costs | Growth in small business financing | Economic downturns |

| Diversified product offering | Regulatory risks | Increased demand for personal loans | Digital security challenges |

Bajaj Finance Competitor Comparison

| Parameter | Bajaj Finance | HDFC Bank | ICICI Bank |

|---|---|---|---|

| Pricing | Competitive rates | Premium rates | Competitive rates |

| Customer Experience | Digital-first, easy access | Personalized service | Omnichannel approach |

| Channel Strategy | Mobile app, website | Branch network | Branch + Digital |

| Market Focus | Mass market, middle-class | Premium market | Mass market |

| Innovation | Instant loan approvals | Custom loan products | Digital banking solutions |

What’s New with Bajaj Finance?

Bajaj Finance has invested heavily in automation, digital platforms, and AI to enhance customer experience. It has also taken significant steps toward sustainability by focusing on eco-friendly financing options for electric vehicles and promoting green loans. With a continuous push for digital innovation, Bajaj Finance remains ahead of the curve in the financial services sector.

Want to Know Why 2,50,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 23, 2026

Duration

11 Months

Live & Online

Best For

Working Professionals

Mode of Learning

Online

Starts from

Mar 6, 2026

Duration

4-6 Months

Online

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.