Punjab National Bank is a state-owned commercial bank that was India’s first ‘Swadeshi’ bank. It began operations on April 12, 1895, in Lahore, with only 2 lakhs sanctioned capital and 20,000 working capital. Today, PNB is the country’s second-largest public sector bank.

In the Punjab National Bank case study, we shall cover the bank’s marketing strategy throughout its extensive journey with the help of its marketing mix, marketing campaigns, SWOT analysis, and social media presence. Let’s get started by learning more about the company.

About Punjab National Bank

The Punjab National Bank (PNB) was established in the spirit of nationalism, and it was the first bank entirely run by Indians and funded entirely by Indian capital. PNB has since merged with 9 other banks throughout the course of its existence.

Personal and corporate banking, commercial, agricultural, and export finance, as well as international banking, are all available services offered by the financial institution. Its lending services include mortgages, car loans, and college loans. Indian conglomerates, small and mid-sized firms, non-resident Indians, and multinational corporations are among PNB’s diverse clientele.

The bank has various subsidiaries such as PNB Gilts Ltd, PNB Investment Services Ltd, PNB Insurance Broking Pvt. Ltd, PNB Cards and Services Ltd, Druk PNB Bank Ltd, and Punjab National Bank (International) Ltd, among various other associates and joint ventures.

Now that we understand the bank’s business and offerings, let’s analyse its marketing starting with its marketing mix.

Marketing Mix of Punjab National Bank

Product, Price, Place, and Promotion are the four major components of a marketing mix. A company’s combination of activities or tactics of marketing its service or product in the marketplace is referred to as the marketing mix. In the case of service offerings instead of products, the marketing mix involves three more Ps- People, Process, and Physical Evidence. Let us talk about the marketing mix of PNB.

Product

Punjab National Bank has a wide geographical presence in India, with branches in personal, rural, and corporate banking. Customers can choose from a variety of products offered by Punjab National Bank, such as:

- Personal services- Deposits, retail and MSME loans, insurance, credit and debit cards, current accounts, agricultural banking, etc.

- Corporate Services- Corporate loans, EXIM finance, exporters gold card scheme, money management services, door-step banking options, etc.

- International services- NRI services, forex services, international cards, offshore banking options, etc.

- Financial Services- Depository services, non-life insurance, mutual funds, retirement schemes, merchant banking, etc.

- E-services like BHIM, PNB Kitty, PNB Yuva, Unified Payments Interface, Retail Internet Banking, Corporate Internet Banking, Mobile Banking, are also offered by the bank.

Pricing

Despite being a state-owned corporation, Punjab National Bank faces stiff competition from the likes of State Bank of India, Corporation Bank, Bank of Maharashtra, State Bank of Mysore, and others. Since the government owns a large portion of the bank, the interest rates set by PNB are lower than those set by private banks, which exist solely to make a profit.

While seeking profit, public banks must ensure that they are the bank of the people, fostering the country’s development. The RBI guidelines, competitor offerings, and business interest rates all influence PNB’s pricing decisions.

Place and Distribution

Punjab National Bank is a state-owned bank that is present Pan-India. Its headquarters are located in New Delhi. The bank has a large customer base of 188 million customers. It has over 10910 branches and 13000 ATMs spread across 764 cities. Given the bank’s extensive presence across the country, the figures show that accessing a Punjab National Bank branch is very convenient. Outside of India, Punjab National Bank has offices in Hong Kong, Dubai, Kabul, Kowloon, Shanghai, Sydney, and Oslo.

Promotion

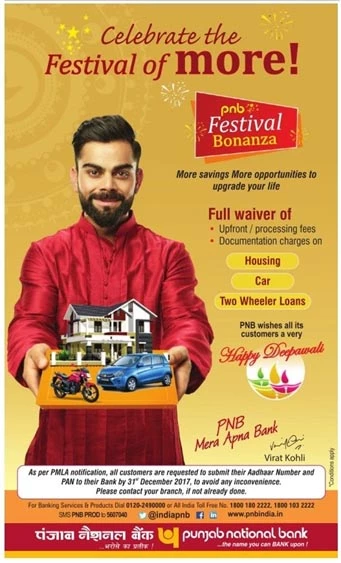

Punjab National Bank participates in a variety of corporate social responsibility programmes, including health screenings, tree-plantation campaigns, recycling drives, the installation of dustbins, the sponsorship of uniforms, and the adoption of villages, among others. This helps in promoting a positive and trusting image to the customers. Punjab National Bank had also partnered with cricketer Virat Kholi as a brand ambassador to garner the interest of young people. We talk about this later on in the blog, under PNB’s marketing campaigns. The bank also promotes itself through audio/video advertisements, print media, social media, underprivileged, and its own website.

People

Punjab National Bank is a massive corporation with over 70,000 employees. PNB employs 919 people with disabilities, according to public records. This is a great way to support the underprivileged and contribute towards society. PNB Parivar is the company’s human resource management software, which refers to the workers as a family. It was established in 2006 with the aim of making payroll processing, wage payments, and employee loan monitoring more transparent. It also acts as a dashboard for all internal news, as well as questions about transfers and postings. This made the company an aspirational organisation for employees to seek employment under.

Process

Punjab National Bank has expanded steadily in both organic and inorganic ways during its extensive journey in the industry. PNB was formed by the merger of nine separate banks, bringing it to its current scale. Some of these banks were:

- Bharat Bank Ltd

- Universal Bank of India

- Indo-Commercial Bank

- New Bank of India

- Nedungadi Bank

Physical Evidence

Since it is a public sector bank, Punjab National Bank’s infrastructure is less technology-centric. It also invests comparatively lesser in customer service. Bottlenecks and bureaucracy are public-sector businesses’ commonly experienced problems, making it difficult to have above-average customer service. However, in terms of speedy transactions, a wide range of services, and extensive facilities, Punjab National Bank’s services are comparable to those of a private bank.

The marketing mix of Punjab National Bank is thus complete, with each strategy and its objectives detailed. Each of these help in envisioning the overall business and marketing strategies of a company. Let’s see how these align with PNB’s marketing strategy.

Marketing Strategy of Punjab National Bank

In this section of the blog, we shall talk about Punjab National Bank’s marketing strategy in terms of its STP i.e. segmentation, targeting, and positioning. Punjab National Bank segregates and targets existing high-value customers. PNB does not geographically segment an exclusive market segment since it has a wide presence in both rural and urban areas.

Their target audience includes people who are self-employed, corporate, or government workers in rural, urban, and metropolitan areas. It also targets teachers, people from low-income families, and others who are financially disadvantaged to avail their services. The bank mainly markets aggressively through print and television media, and via call centers and outbound sales forces to procure new customers or at least increase brand awareness.

Over the years, PNB has mainly positioned itself based on its value proposition. Today, it emphasises upon its telebanking, net banking, internet banking, and other value-added services with the aim to communicate its image as a value-providing bank. This is how PNB segments and targets its audience, positioning itself appropriately.

One of the most effective ways to position a brand and to communicate to a target audience, is by way of marketing campaigns. In the next section of the blog, we shall look at some of PNB’s campaigns.

PNB’s Marketing Campaigns

Throughout its decades-long presence in the industry, Punjab National Bank has carried out many advertising and marketing campaigns. Following are two of the bank’s most popular campaigns:

-

“Digital Apnayen”

On the occasion of Independence Day, 15 August 2020, the bank’s Managing Director S S Mallikarjuna Rao launched the campaign. The campaign aimed to enable and encourage customers to use digital platforms and donate to the PM CARES Fund for COVID-19 relief through PNB. This Campaign was thus named “Digital Apnayen”. Under this campaign, the bank pledged to donate Rs 5 to the PM CARES Fund on behalf of each customer who made their first financial transaction to unlock their RuPay Debit card, either at a point of sale (PoS) or via an e-commerce site. It was an overall effort to get customers to avail their services while also contributing to a believed noble cause.

-

#JoinTeamKohli

PNB’s then brand ambassador Virat Kohli featured in a host of advertisements. Ranging from festive ones, to informative ones, #JoinTeamKohli being the recurring hashtag used to encourage customers to join Virat in availing the bank’s services. The cricketer genuinely marketed the brand and was quoted saying that he was an account holder since he was 16. Each advertisement under these campaigns ended with an assuring “Mera Apna Bank” note from Kohli.

Advertising and marketing campaigns are also widely conducted via social media and digital platforms in today’s times. We shall thus analyse PNB’s social media marketing presence now and see how it manages to build its digital brand position.

Digital Marketing Presence

Social Media today plays an important role for a company to make its brand accessible. As the use of social media increases by the day, it is becoming an important tool to reach out to potential customers and increase brand recognition. We Following is PNB’s digital presence summary:

- Punjab National Bank has 61.4K followers on Instagram, 212Kfollowers on Twitter, and 1.2M likes on Facebook.

- PNB posts daily and most of their posts are about their offerings and policies.

- Their content is both in English and Hindi for providing easy access to their audience.

- They run various contests to engage and interact with their followers. For example, they recently hosted a digital literacy contest in the form of a crossword puzzle activity.

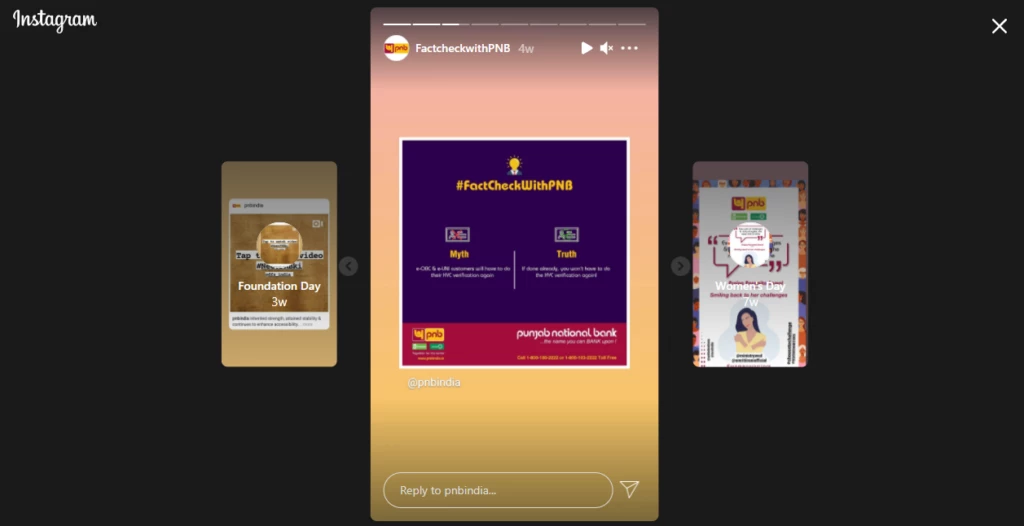

- The bank also posts content in public interest and awareness. For example, they started a campaign called #FactCheckWithPNB, wherein they debunked common banking misconceptions.

- The bank practices festive marketing by promoting relevant services on account of festivals, while wishing customers.

- Socially conscious initiatives are also undertaken by the bank, by celebrating Earth Day, Women’s Day, World Health Day, etc

PNB is certainly trying its best to be engaged with its digital audience and post relevant content accordingly.

Finally, using all of the information we collected, we conducted PNB’s SWOT analysis to summarise its position and operations.

SWOT Analysis of Punjab National Bank

The SWOT analysis of a business spells out its strengths, weaknesses, opportunities, and threats, all of which can lead to the company’s downturn or growth. It is a form of strategic planning that helps an organisation determine its current position. The SWOT analysis of Punjab National Bank can be seen in the table below:

Strengths of PNB

- Large client base of 188 million customers.

- PNB has a large network of branches and ATMs, with 10910 branches and over 13000 ATMs.

- Some of the famous banks, such as United Bank of India and OBC (Oriental Bank of Commerce) have merged with PNB

- Significant international presence

- Strong I.T. operations

Weaknesses Of PNB

- Less penetration and presence in the rural areas.

- Inadequate advertising and branding as compared to other private sector banks.

- Negative news coverage for Involvement in malpractice leading to an unfavourable brand image in the minds of the customers’.

Opportunities for PNB

- PNB could launch its own E-Wallets, which are currently popular in the country.

- E-Gateway can be offered to website owners for a small fee.

- To attract more clients, the bank could place a greater focus on business loans.

- To increase its cash deposit ratio, the bank could introduce new savings account schemes.

Threats to PNB

- The main challenge is economic fluctuations and crises.

- The Bank is also threatened by RBI and government regulations.

- Competitors, both new and old

Conclusion

The Punjab National Bank has managed to be in business for many years. Its core services and offerings are up to industry standards. As we discussed in the marketing mix, they are very accessible to the general public and also use standard promotional techniques to increase their client base.

Their marketing efforts over the years had proven successful, along with their social media presence as well. But due to their brand’s coverage in recent controversies, the common man’s perception remains hesitant and unfavourable. They need to actively work on revamping their brand perception and image to be able to gain consumers’ trust and business.

That brings us to the end of this case study. We hope you enjoyed reading this blog and found our information useful. If you did, share it with your peers and friends and like the blog. Thank you!

0 Comments